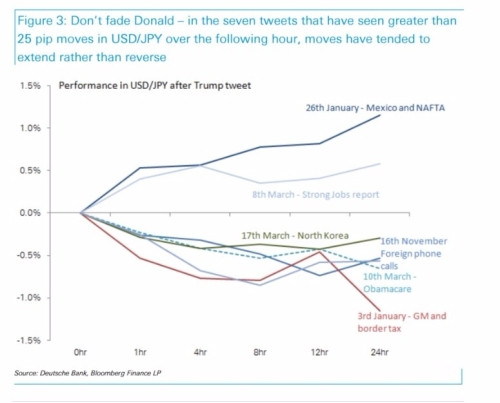

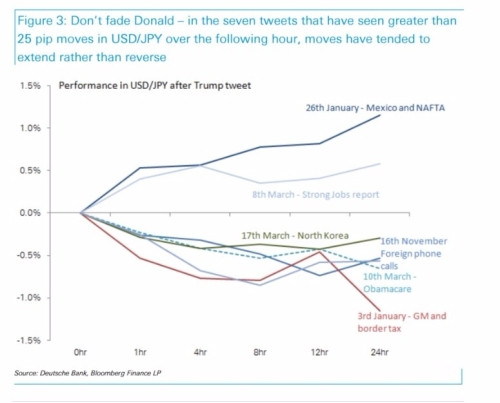

I have noticed for some time the Dukascopy Traders have had more faith in the UJ than American traders. The following statement came from DB .// Trump’s tweet storms don’t shake up the foreign exchange markets as much as you might think. But when they do, it’s time to get on board. That’s the conclusion of a Deutsche Bank study, which says that when a currency moves by a least a quarter of a percent on his tweets, it keeps going in that direction for at least 12 hours. And that's a lifetime in the world of financial markets.

Chart Trump Twts

When Vladimir Putin talked with Donald Trump Tuesday, the two leaders tried to move past the tensions triggered by last month’s U.S. missile strike on Russia’s ally Syria.

Global HeadlinesFrench showdown | Forget campaign rallies, tactics or even policies, it’s now all down to delivery. Marine Le Pen and Emmanuel Macron will go head-to-head in tonight’s debate before Sunday’s final round of the French presidential election. It will give Le Pen her last chance to deploy her nationalist soundbites in a bid to cut into Macron’s 20 point-lead. The debate starts at 9 p.m. in Paris (3 p.m. EST) and you can follow our live blog here.

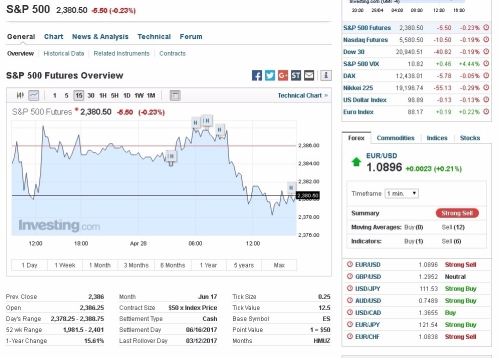

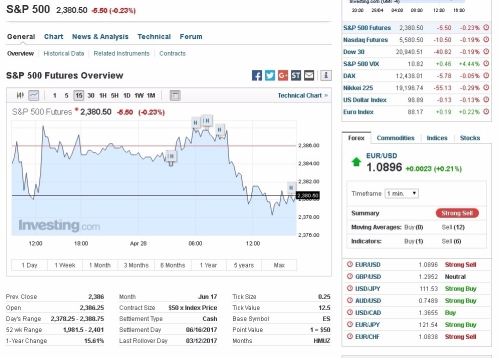

My decision to sell UJ was based on SP Futures

My decision to sell UJ was based on SP Futures

I am inclined to add another sell at 112.30// Am I nuts?

Chart Trump Twts

My decision to sell UJ was based on SP Futures

My decision to sell UJ was based on SP Futures

I am inclined to add another sell at 112.30// Am I nuts?