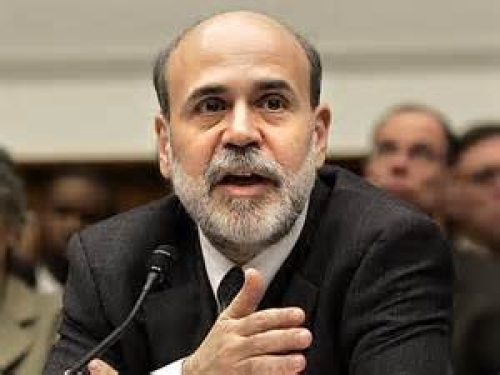

US Federal Reserve Chairman Ben Bernanke's semi-annual testimony on monetary policy before the Congress is one of the key market-moving events. Especially this time, it will be Bernanke’s last time in front of Congress before his term ends in 2014.

Bernanke heads to Capitol Hill on Wednesday and Thursday, first going up to the House Financial Services Committee to deliver the semi-annual monetary policy report, and the next day heading to the Senate Banking Committee.

Now, the markets have been confused by contradictory statements coming from various Fed members, especially from Bernanke himself. And confusion cased by the Federal Reserve created volatility and even panic in financial market.

Now, what to expect this time? During the opening statement, most likely Bernanke will express his personal opinion and argue for more monetary ease. He’ll highlight that the still weak economy needs continued accommodative monetary policy. Especially, after US economic data for the second quarter came lower than government expected. For example, U.S. retail sales rose only 0.4% in June below expectations of 0.8% and GDP growth was disappointing.

The United States is a consumer driven economy and disappointing economic growth gives Bernanke a reason to be cautions.

On the other hand, don’t forget that Bernanke is a Chairman of the Federal Reserve and he represents the entire Open Market Committee. During the question and answer sessions with members of Congress, Bernanke will express opinions of the entire Federal Reserve. That’s when he’ll speak about the end of the bond purchasing program.

Based on the minutes of the last Fed meeting, about half of the 19 voting members wanted to end bond purchasing program by the end of this year. Meanwhile, the other half wanted to keep buying bonds well into the future.

So, there will be something for everyone this time and the most likely outcome of the Bernanke’s testimony to be confusing again for the market. Experts believe that Bernanke will do everything he can to keep stock prices higher and markets should be cautious with this speech. Again, we might see more volatility in the market and even panic from investors.

And based on the past, never say never with Bernanke and he might surprise markets again.