Bunk HIGHLIGHTS:

GBP net-long among vast theorists bounces with ascend in money

JPY expansive specs secured at a forceful clasp on hazard avoidance

Valuable metals saw enormous changes, particularly silver

For shorter-term assessment readings, see the IG Client Sentiment page.

This previous week's report featured a couple of critical changes in situating among huge examiners. Sterling brokers keep on being idealistic on the money, incline supports more upside. There was huge short covering in the Japanese yen as hazard avoidance proceeds. Swinging to valuable metals, situating in silver turns additionally net-short, a surprising event.

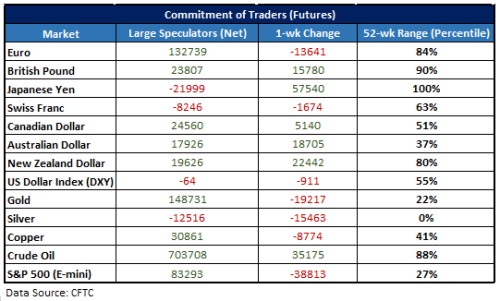

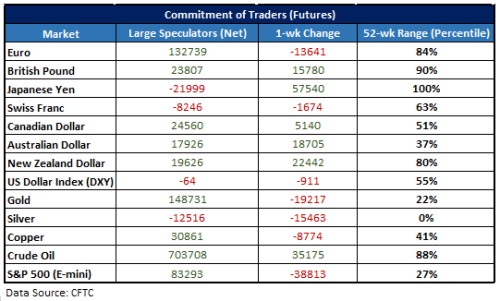

Every Friday, the CFTC discharges their week after week report of merchants' situating in the prospects showcase as revealed for the week finishing on Tuesday. In the table beneath are key measurements for net situating of huge theorists (i.e. speculative stock investments, CTAs, and so forth.). This gathering of brokers are to a great extent known to be drift adherents because of the techniques they commonly utilize. The course of their position, size of changes, and in addition extremes are mulled over while dissecting what their action could mean about future value variances.

Key details: Net position, one-week change, and where the present position stands with respect to the previous 52 weeks.

GBP net-long among vast theorists bounces with ascend in money

JPY expansive specs secured at a forceful clasp on hazard avoidance

Valuable metals saw enormous changes, particularly silver

For shorter-term assessment readings, see the IG Client Sentiment page.

This previous week's report featured a couple of critical changes in situating among huge examiners. Sterling brokers keep on being idealistic on the money, incline supports more upside. There was huge short covering in the Japanese yen as hazard avoidance proceeds. Swinging to valuable metals, situating in silver turns additionally net-short, a surprising event.

Every Friday, the CFTC discharges their week after week report of merchants' situating in the prospects showcase as revealed for the week finishing on Tuesday. In the table beneath are key measurements for net situating of huge theorists (i.e. speculative stock investments, CTAs, and so forth.). This gathering of brokers are to a great extent known to be drift adherents because of the techniques they commonly utilize. The course of their position, size of changes, and in addition extremes are mulled over while dissecting what their action could mean about future value variances.

Key details: Net position, one-week change, and where the present position stands with respect to the previous 52 weeks.