Full report

Video version will be available here.

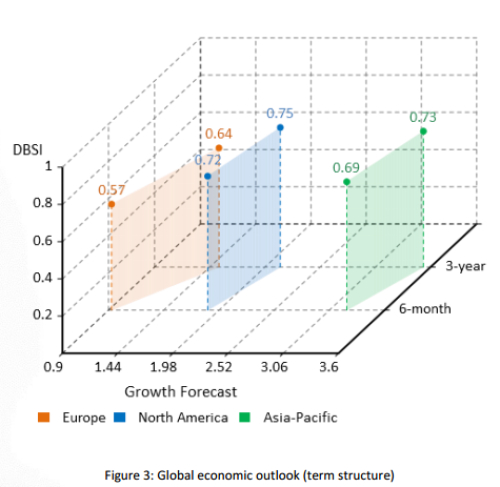

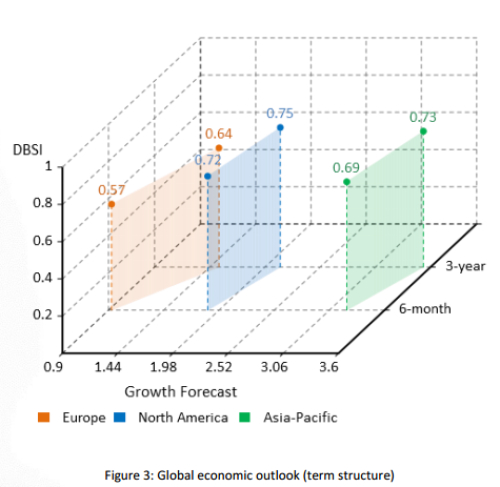

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Expected growth for the European economy six months from now surged to 0.93% from 0.77% in the previous month, reaching the highest level this year. The same applies to the three-year growth outlook, with the corresponding measure increasing to 1.53% compared to the March figure of 1%.

Experts revised upwards their six-month economic outlook for North America, expecting the region’s economy to expand 1.87% in October 2014, up from 1.83% growth rate predicted in the March report. As to the three-year growth outlook, it appears that professors were more upbeat during the winter months, anticipating 2.53% and 2.27% expansion in January and February, respectively. As spring has come, they have become less confident concerning the growth of the U.S. and Canada, with the anticipated growth rate standing at 2.13% in the April report.

Asia-Pacific economic growth is expected to post slightly lower figures both in the medium and long term. Since the beginning of the year there have been fluctuations in professors’ expectations. In April, their forecasts were not that optimistic compared to the prior month. Thus, they saw the region’s economy growing at 3.23% pace in six months and at 3.53% in three years.

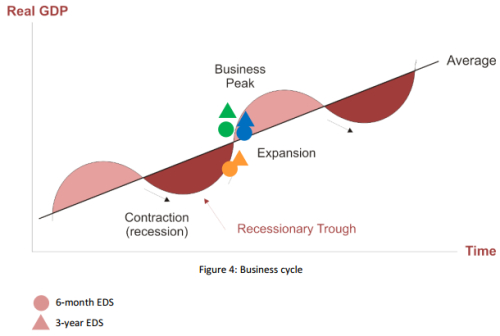

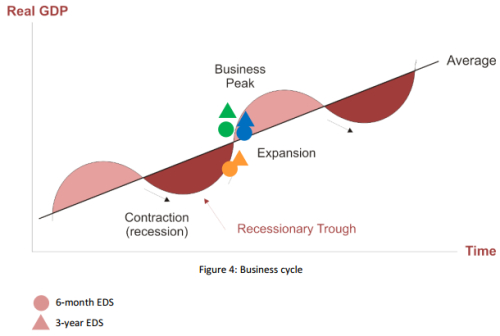

Figure 4 presents the business cycle and its phases: expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

The number of respondents who predict the European economy will move up along the business cycle curve in the near and long term increased in April, with 15 of those surveyed expecting the economy to reach the expansion phase six months from now, while 22 professors see the economy moving further away from the recessionary territory.

The same picture is seen in North America, where the majority (27) of respondents anticipates the economy to enter the expansion phase in the short term. 3-year EDS also speaks in favour of further movement to the Business Peak territory.

More and more people expect the Asia-Pacific region to reach the Business Peak, with the corresponding number having increased to from 1 seen in March. However, the 3-year EDS seems less optimistic compared to March findings.

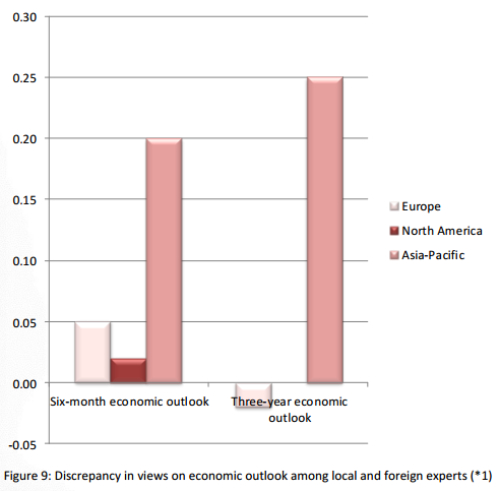

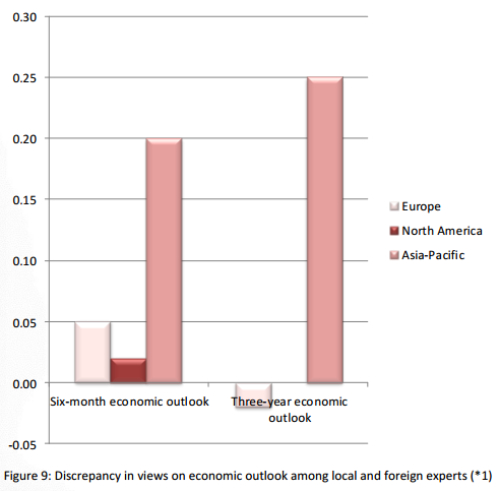

Figure 9 presents a discrepancy in views on the economic outlook among the local and foreign experts. April poll results reveal that respondents from Europe are more optimistic about the local six-month economic outlook compared to their foreign colleagues. The same is true for the Asia-Pacific and North American regions. However, the picture is quite different when comparing professors’ long-run economic assessment.

Europe: While local experts evaluate the region’s economy more positively over the next six months, with the discrepancy in opinions being 0.05, they seem to underestimate European economy over the long term period, as foreign experts feel more upbeat when assessing three-year economic prospects (0.63 vs. 0.65).

North America: Local respondents from North America are more optimistic about the regional six-month outlook (0.73 vs. 0.71); however, it appears that both local and foreign professors are unanimous when it comes to the three-year growth prospects.

Asia-Pacific: Local experts constantly tend to be more upbeat about their economic situation than their foreign colleagues over the past four months. In April the discrepancy in views rose to the record of 0.2 for the short term outlook and 0.25 for the tree-year sentiment.

Video version will be available here.

- Dukascopy Sentiment Index shows that academic experts have become more optimistic about the short and long term outlooks for Europe, North America as well as the global economy, with the corresponding gauges inching higher. However, professors lost some of their faith in the Asia-Pacific region even despite brighter economic prospects for New Zealand and Australia. This might be due to the fact that China’s economy has been slowing further, while Japan decided to hike sales tax, which is estimated to significantly affect the fragile economic recovery in the world’s third-largest economy.

- Professors appeared to be even more upbeat when assessing the North American economy compared to the previous month’s results, as the economy shrugged off the harsh winter. Six-month outlook rose 0.04 to 0.72, while the three-year sentiment advanced 0.06, posting the biggest increase amidst other regions.

- The measure of Europe’s outlook continues to move in the uptrend which started in March, following a decrease in the first months of the year.

Figure 3 represents the term structure of Dukascopy Bank Sentiment Index (Y-axis) mapped against GDP growth forecasts made by poll respondents (X-axis). Overall, DBSI values and GDP growth forecasts match directionally, suggesting the global economy will perform better three years from now.

Expected growth for the European economy six months from now surged to 0.93% from 0.77% in the previous month, reaching the highest level this year. The same applies to the three-year growth outlook, with the corresponding measure increasing to 1.53% compared to the March figure of 1%.

Experts revised upwards their six-month economic outlook for North America, expecting the region’s economy to expand 1.87% in October 2014, up from 1.83% growth rate predicted in the March report. As to the three-year growth outlook, it appears that professors were more upbeat during the winter months, anticipating 2.53% and 2.27% expansion in January and February, respectively. As spring has come, they have become less confident concerning the growth of the U.S. and Canada, with the anticipated growth rate standing at 2.13% in the April report.

Asia-Pacific economic growth is expected to post slightly lower figures both in the medium and long term. Since the beginning of the year there have been fluctuations in professors’ expectations. In April, their forecasts were not that optimistic compared to the prior month. Thus, they saw the region’s economy growing at 3.23% pace in six months and at 3.53% in three years.

Figure 4 presents the business cycle and its phases: expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

The number of respondents who predict the European economy will move up along the business cycle curve in the near and long term increased in April, with 15 of those surveyed expecting the economy to reach the expansion phase six months from now, while 22 professors see the economy moving further away from the recessionary territory.

The same picture is seen in North America, where the majority (27) of respondents anticipates the economy to enter the expansion phase in the short term. 3-year EDS also speaks in favour of further movement to the Business Peak territory.

More and more people expect the Asia-Pacific region to reach the Business Peak, with the corresponding number having increased to from 1 seen in March. However, the 3-year EDS seems less optimistic compared to March findings.

Figure 9 presents a discrepancy in views on the economic outlook among the local and foreign experts. April poll results reveal that respondents from Europe are more optimistic about the local six-month economic outlook compared to their foreign colleagues. The same is true for the Asia-Pacific and North American regions. However, the picture is quite different when comparing professors’ long-run economic assessment.

Europe: While local experts evaluate the region’s economy more positively over the next six months, with the discrepancy in opinions being 0.05, they seem to underestimate European economy over the long term period, as foreign experts feel more upbeat when assessing three-year economic prospects (0.63 vs. 0.65).

North America: Local respondents from North America are more optimistic about the regional six-month outlook (0.73 vs. 0.71); however, it appears that both local and foreign professors are unanimous when it comes to the three-year growth prospects.

Asia-Pacific: Local experts constantly tend to be more upbeat about their economic situation than their foreign colleagues over the past four months. In April the discrepancy in views rose to the record of 0.2 for the short term outlook and 0.25 for the tree-year sentiment.