Hello everyone!

Another article about the winning strategy EMA 9, which this time won 1st Place in Contest Apr 2019. The strategy is the same that took 2nd place in December 2018. About that time, in the contest article, I said that I have the expectation of this strategy win the contest and, four months later, it happened! I am really happy about it!

This is how the strategy works, since maybe you haven’t seen the last article explaining the details of the strategy:

The Strategy in Detail

The strategy is extremely simple and uses only two indicators to open positions. The first, and most important, is the 9-period exponential moving average (EMA) that defines when the entry trigger will be given and in which direction the position will be opened. The second is the ADX, later placed as a fine-tuning, allowing the trigger to be triggered only when the ADX indicates that the market is in trend. The EMA trigger works very simply. If the candle (period 1 hour) opens above the EMA and closes below the EMA, a pending short order will be placed at the minimum of the candle, opening the position if the market movement continues downward. The same happens if the candle opens below the EMA and closes above it. A long pending order will be placed at the maximum of the candle, opening the position if the market continues to rise. ADX works as a filter, not allowing orders to be placed if its value is below 16. Let's look at some pictures to understand better:

Picture 1. Short position placed after candle opens above EMA 9 and closes below.

Picture 1. Short position placed after candle opens above EMA 9 and closes below.

In the picture we can see that there was no time for the pending position to be placed, because the candle made a marubozu, following a down movement and earning 5 pips of profit. On the same day, three hours later, we checked the candle at 14:00, overtaking the EMA from the bottom up, opening a pending position at the maximum of the candle:

Picture 2. Pending order placed on the maximum of the candle, after the candle opens below the EMA and closes above it.

Picture 2. Pending order placed on the maximum of the candle, after the candle opens below the EMA and closes above it.

In this case, we can follow the opening of the pending position, as the candle has created a wick after its closure. The next hour, the position is open as the market continues to rise, and get another 5 pips of profit in the long position:

Picture 3. Pending position becomes open position and gains 5 pips of profit.

Picture 3. Pending position becomes open position and gains 5 pips of profit.

During the two operations, we can verify that the ADX indicator was above 16 points, allowing positions to be opened:

Picture 4. In both operations, the ADX indicator was above 16 points.

Picture 4. In both operations, the ADX indicator was above 16 points.

An improvement in the strategy, which did not exist in its original version, was the use of a trailing stop, with a step of only 1 pip, after 5 pips of profit. This allows to pick up sudden market movements, not limiting the order to just 5 pips of profit, when the market goes up or down quickly:

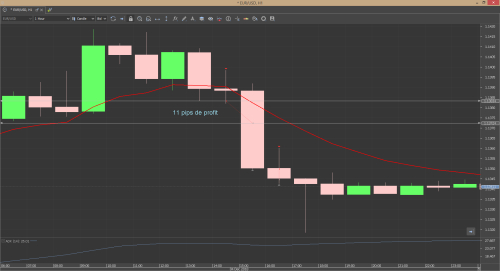

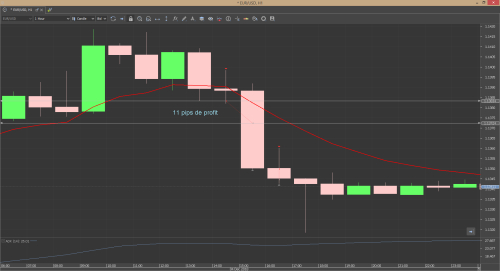

Picture 5. Operation of 11 pips of profit, achieved through the use of trailing stop.

Picture 5. Operation of 11 pips of profit, achieved through the use of trailing stop.

Another implementation made in the strategy was to make it more dynamic. Sometimes, pending positions took days to execute, not allowing other positions to be opened, since the strategy accepts only one order at a time. A logic was then implemented in order to cancel pending orders at the end of the day, closing the pending positions that did not open during that day.

The choice of the 60 pips stop loss, and the 5 pips trailing step trigger, were conclusions designed and analyzed through a number of backtests and EUR / USD pair analyzes, noticing that was a successful combination for that pair. Through several backtests and also with the use of the optimization tool of JForex the value of 10 lots for trading amount also shown a excellent performance.

Conclusion

As expected, the strategy won the 1st place in contest, as predicted in the beginning of 2019. I believe it has the potential to win other prizes, along this year. Still, the strategy could be improved to take better results in long term trading, maybe changing ratio S/L-T/P and choosing pair which follow tendencies. Anyway, I believe this contests and community is a extraordinary place to exchange experience and ideas of trading, and I am open to suggestions in how to improve even more this good strategy.

Another article about the winning strategy EMA 9, which this time won 1st Place in Contest Apr 2019. The strategy is the same that took 2nd place in December 2018. About that time, in the contest article, I said that I have the expectation of this strategy win the contest and, four months later, it happened! I am really happy about it!

This is how the strategy works, since maybe you haven’t seen the last article explaining the details of the strategy:

The Strategy in Detail

The strategy is extremely simple and uses only two indicators to open positions. The first, and most important, is the 9-period exponential moving average (EMA) that defines when the entry trigger will be given and in which direction the position will be opened. The second is the ADX, later placed as a fine-tuning, allowing the trigger to be triggered only when the ADX indicates that the market is in trend. The EMA trigger works very simply. If the candle (period 1 hour) opens above the EMA and closes below the EMA, a pending short order will be placed at the minimum of the candle, opening the position if the market movement continues downward. The same happens if the candle opens below the EMA and closes above it. A long pending order will be placed at the maximum of the candle, opening the position if the market continues to rise. ADX works as a filter, not allowing orders to be placed if its value is below 16. Let's look at some pictures to understand better:

Picture 1. Short position placed after candle opens above EMA 9 and closes below.

Picture 1. Short position placed after candle opens above EMA 9 and closes below.In the picture we can see that there was no time for the pending position to be placed, because the candle made a marubozu, following a down movement and earning 5 pips of profit. On the same day, three hours later, we checked the candle at 14:00, overtaking the EMA from the bottom up, opening a pending position at the maximum of the candle:

Picture 2. Pending order placed on the maximum of the candle, after the candle opens below the EMA and closes above it.

Picture 2. Pending order placed on the maximum of the candle, after the candle opens below the EMA and closes above it.In this case, we can follow the opening of the pending position, as the candle has created a wick after its closure. The next hour, the position is open as the market continues to rise, and get another 5 pips of profit in the long position:

Picture 3. Pending position becomes open position and gains 5 pips of profit.

Picture 3. Pending position becomes open position and gains 5 pips of profit.During the two operations, we can verify that the ADX indicator was above 16 points, allowing positions to be opened:

Picture 4. In both operations, the ADX indicator was above 16 points.

Picture 4. In both operations, the ADX indicator was above 16 points.An improvement in the strategy, which did not exist in its original version, was the use of a trailing stop, with a step of only 1 pip, after 5 pips of profit. This allows to pick up sudden market movements, not limiting the order to just 5 pips of profit, when the market goes up or down quickly:

Picture 5. Operation of 11 pips of profit, achieved through the use of trailing stop.

Picture 5. Operation of 11 pips of profit, achieved through the use of trailing stop.Another implementation made in the strategy was to make it more dynamic. Sometimes, pending positions took days to execute, not allowing other positions to be opened, since the strategy accepts only one order at a time. A logic was then implemented in order to cancel pending orders at the end of the day, closing the pending positions that did not open during that day.

The choice of the 60 pips stop loss, and the 5 pips trailing step trigger, were conclusions designed and analyzed through a number of backtests and EUR / USD pair analyzes, noticing that was a successful combination for that pair. Through several backtests and also with the use of the optimization tool of JForex the value of 10 lots for trading amount also shown a excellent performance.

Conclusion

As expected, the strategy won the 1st place in contest, as predicted in the beginning of 2019. I believe it has the potential to win other prizes, along this year. Still, the strategy could be improved to take better results in long term trading, maybe changing ratio S/L-T/P and choosing pair which follow tendencies. Anyway, I believe this contests and community is a extraordinary place to exchange experience and ideas of trading, and I am open to suggestions in how to improve even more this good strategy.