Hello! Since in September I won 2nd place in the strategy contest and now I will explain my strategy. I wrote this strategy a few years ago, it reached version 15 and I have not changed it since. The idea with which I wrote it was to be simple and profitable.

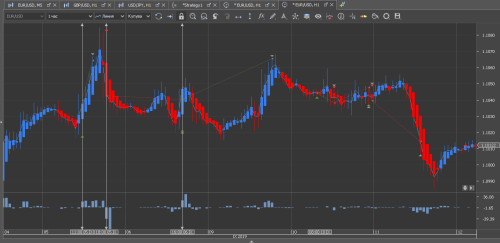

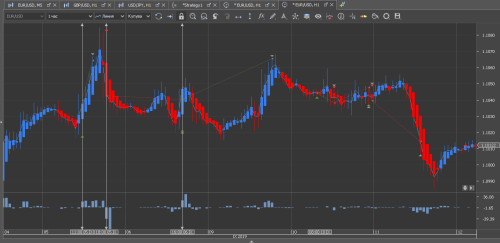

My strategy is using pair EURUSD and the H1 timeframe with HeikenAshi and TVS indicators. I am using TVS indicator to determine the direction. With TVS indicator we can get the comparison of defined time periods and the relation between price and volume. When the TSV crosses above the zero line it signals a positive accumulation or buying pressure showing the possibility of a bullish state. On the other hand, if TSV crosses below the zero line it indicates a distribution or selling pressure where we can enter in a bearish market. I am using HA indicator for input. The HeikenAshi technique modifies the open-high-low-close series that most candlestick charts use, this makes trends easier to spot.

Trading Logic: If tvs > 0 and previous HAbar is down and current HAbar is up = buy signal when opened next bar.

If tvs< 0 and previous HA bar is up and current HA bar is down = sell signal when opened next bar.

If tvs< 0 and previous HA bar is up and current HA bar is down = sell signal when opened next bar.

Trade amount = 5m, TP = 25, SL = 50.The settings are consistent with the requirements for a munimum of 20 trades.

Trade amount = 5m, TP = 25, SL = 50.The settings are consistent with the requirements for a munimum of 20 trades.

Tanks Dukascopy for 2nd place!

P.S. The code of the strategy contains MA indicators (2, 8, 13, 21) and trailing stop which are not used but could be included in logic or completely change it.

My strategy is using pair EURUSD and the H1 timeframe with HeikenAshi and TVS indicators. I am using TVS indicator to determine the direction. With TVS indicator we can get the comparison of defined time periods and the relation between price and volume. When the TSV crosses above the zero line it signals a positive accumulation or buying pressure showing the possibility of a bullish state. On the other hand, if TSV crosses below the zero line it indicates a distribution or selling pressure where we can enter in a bearish market. I am using HA indicator for input. The HeikenAshi technique modifies the open-high-low-close series that most candlestick charts use, this makes trends easier to spot.

Trading Logic: If tvs > 0 and previous HAbar is down and current HAbar is up = buy signal when opened next bar.

If tvs< 0 and previous HA bar is up and current HA bar is down = sell signal when opened next bar.

If tvs< 0 and previous HA bar is up and current HA bar is down = sell signal when opened next bar.

Trade amount = 5m, TP = 25, SL = 50.The settings are consistent with the requirements for a munimum of 20 trades.

Trade amount = 5m, TP = 25, SL = 50.The settings are consistent with the requirements for a munimum of 20 trades.Tanks Dukascopy for 2nd place!

P.S. The code of the strategy contains MA indicators (2, 8, 13, 21) and trailing stop which are not used but could be included in logic or completely change it.