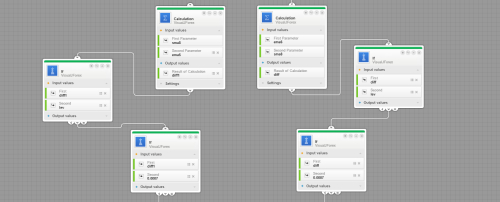

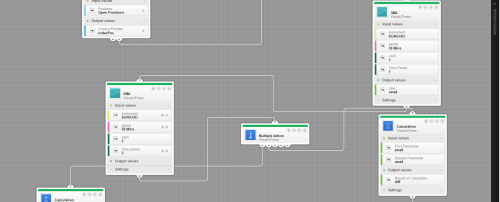

sma7ema5vvj5 is a visuel jforex version of my strategy sma7ema5 , it's based on relative position of Simple moving average (7) et exponential moving average (3) with stop is fixed at 63 pip and 14 PIP as tp .

My strategy works on eurusd ,and on thirty minutes period, the indicators used in this strategy are : - exponential moving average (Time period :3) applied on (MEDIAN_BID_PRICE) and the variable used in script (ema6) and Simple moving average (Time period:7) applied on (MEDIAN_BID_PRICE) and the variable used in script (sma8), Script of the strategy use onCandel ; with the opening of each new Candel ; relative position of (ema 3) and ( sma 7) decides what position will be opened. Shorts : when the EMA(3) is below it means difference (diff1 = sma8-ema 6) is positive and less than 7 PIP then it is a short position at market price . Stop Loss is 63 pips above Open of the last bar closed (the stop is fixed) . Take Profil is 14 pips below the Close of the last bar closed .

long postion : when the ema(3) is above the it means the difference (diff = ema6-sma 8) is positive and less than 7 PIP then we have a purchase order at market price . Stop Loss is 63 pips below Open of the last bar closed (the stop is fixed) and Take Profil is 14 pips above the Close of the last bar closed .

The amount is fixed at 5.000M and is to review after evaluating the results of the strategy in different market situations The ratio (TP /Stop ) and the percentage of winning positions are key to the success of this strategy Rmq: In version 13,14 and 15 amount is calculated by formula : Equity/2000 version 13 : st 33 tp 9 version 14 : st 63 tp 21 version 15 : st 63 tp 9

to test the strategy I made it under test in the competition several months, the statistics show that the first version is the most reliable, it is this version which allowed me to win in February 2021 and several months before, but it remains to improve its behavior during periods at high volatility.

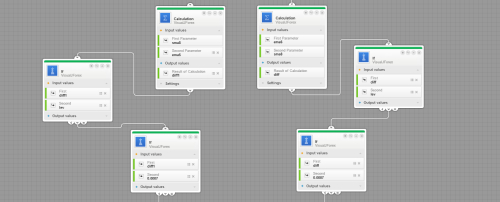

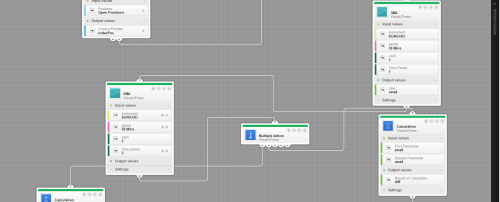

My strategy works on eurusd ,and on thirty minutes period, the indicators used in this strategy are : - exponential moving average (Time period :3) applied on (MEDIAN_BID_PRICE) and the variable used in script (ema6) and Simple moving average (Time period:7) applied on (MEDIAN_BID_PRICE) and the variable used in script (sma8), Script of the strategy use onCandel ; with the opening of each new Candel ; relative position of (ema 3) and ( sma 7) decides what position will be opened. Shorts : when the EMA(3) is below it means difference (diff1 = sma8-ema 6) is positive and less than 7 PIP then it is a short position at market price . Stop Loss is 63 pips above Open of the last bar closed (the stop is fixed) . Take Profil is 14 pips below the Close of the last bar closed .

long postion : when the ema(3) is above the it means the difference (diff = ema6-sma 8) is positive and less than 7 PIP then we have a purchase order at market price . Stop Loss is 63 pips below Open of the last bar closed (the stop is fixed) and Take Profil is 14 pips above the Close of the last bar closed .

The amount is fixed at 5.000M and is to review after evaluating the results of the strategy in different market situations The ratio (TP /Stop ) and the percentage of winning positions are key to the success of this strategy Rmq: In version 13,14 and 15 amount is calculated by formula : Equity/2000 version 13 : st 33 tp 9 version 14 : st 63 tp 21 version 15 : st 63 tp 9

to test the strategy I made it under test in the competition several months, the statistics show that the first version is the most reliable, it is this version which allowed me to win in February 2021 and several months before, but it remains to improve its behavior during periods at high volatility.