Here my strategy explanation for the month of december 2021 . its the same version of Previous months . so nothing changed yet .

EMA is one of the best indicators you can use to open trades. here i used EMA 14 and EUR/USD as an instrument and default period 30 minute . full margen as trade volume ( with leverege of 100 ) with 100 pip stop lose and 4 pip take profit .

The EMA blocks with shift 4,3,2,1 and time period 14 , and get historical candle with shift 4,3,2,1 alllowed me to make this conditions to open orders

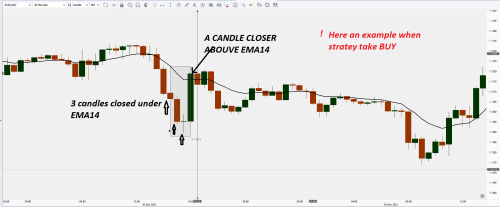

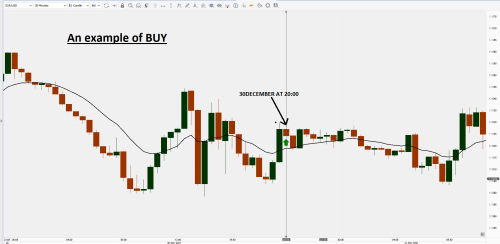

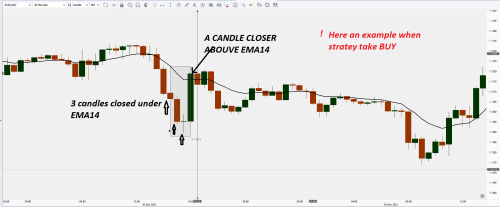

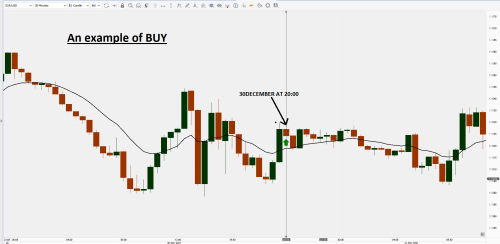

if the EMA closed price shift( 4,3,2) is greater than the candle closed price shift (4,3,2) then EMA close price shift( 1) is less than the candle close price shift (1) ( the meaning is if the Previous 3 candles closer lower than the ema indicator then the last candle close greater than ema ) the strategy will open buy positon

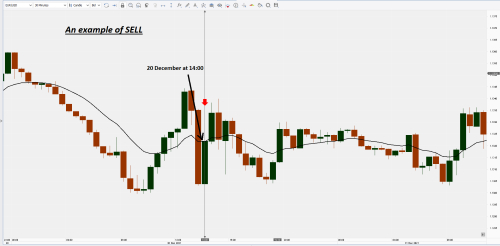

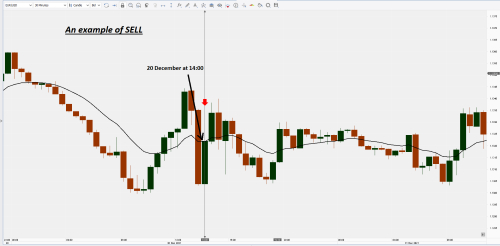

on case of SELL we have the opposite conditions if the EMA close price shift( 4,3,2) is less than the candle close price shift (4,3,2) then EMA close price shift( 1) is greater than the candle close price shift (1) ( the meaning is if the Previous3 candles closer greater than the EMA indicator then the last candle close less than EMA ) the strategy open SELL.

in the previous version i used blocks for exclude monday and friday from trading but the strategy didn't make enough orders so i canceled this idea the strategy working on all days, and for now im not willing to change anything

EMA is one of the best indicators you can use to open trades. here i used EMA 14 and EUR/USD as an instrument and default period 30 minute . full margen as trade volume ( with leverege of 100 ) with 100 pip stop lose and 4 pip take profit .

The EMA blocks with shift 4,3,2,1 and time period 14 , and get historical candle with shift 4,3,2,1 alllowed me to make this conditions to open orders

if the EMA closed price shift( 4,3,2) is greater than the candle closed price shift (4,3,2) then EMA close price shift( 1) is less than the candle close price shift (1) ( the meaning is if the Previous 3 candles closer lower than the ema indicator then the last candle close greater than ema ) the strategy will open buy positon

on case of SELL we have the opposite conditions if the EMA close price shift( 4,3,2) is less than the candle close price shift (4,3,2) then EMA close price shift( 1) is greater than the candle close price shift (1) ( the meaning is if the Previous3 candles closer greater than the EMA indicator then the last candle close less than EMA ) the strategy open SELL.

in the previous version i used blocks for exclude monday and friday from trading but the strategy didn't make enough orders so i canceled this idea the strategy working on all days, and for now im not willing to change anything