In this article, I will talk about technical analysis patterns in theory and practical examples. The study of these patterns helps us in the development of any strategy. In particular, they are very helpful in optimizing overbought and oversold strategies (like my contest strategy). These patterns can be used as trade confirmation of an overbought / oversold signal.

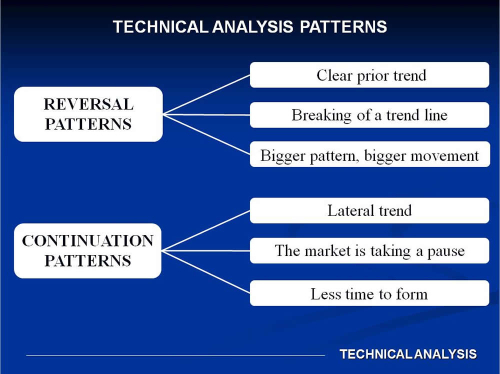

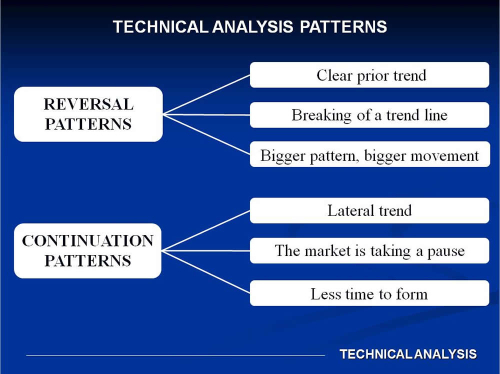

Looking for patterns in financial time series is the key objective of a technical analyst. These patterns are indicative of reversal trend or continuation trend.

Formally, patterns in financial time series from the point of view of the technical analysis are "images or formations that appear on price charts." These can be classified into different categories and have predictive value.

The reversal patterns

These patterns announcing that it is causing a significant change in the trend. The reversal patterns have common characteristics, among which we can mention:

• There must be a precise previous trend, that is, there cannot be a trend change if there is no clear previous trend.

• In general, the first change sign is the breaking of a trend line. It is important to note that the opposite is not true, the trend line break does not necessarily mean a change in the trend, and this can mean only a change in the trend slope.

• While more big is the pattern, more big is the movement associated with their occurrence, where "more big” refers to the height and width of the pattern, the height measures the volatility and the width, the time in which it is formed.

As is standard in technical analysis, does not mean it always will produce all these characteristics, only that there is a significant probability of occurring.

The continuation patterns

These patterns indicate that lateral movement that shows the chart is a pause and then the original trend will continue. The continuation patterns take less time to form that the reversal patterns.

Importantly, both patterns (continuation and reversal) are not deterministic, they are stochastic in nature, that is, when these patterns are formed there is a significant probability that the market movement behaves as expected, but we must remember that there is also the probability, (lower but not null), that this is not so.

Now, we will see some patterns examples: Fig.1: The head and shoulders pattern (reversal)

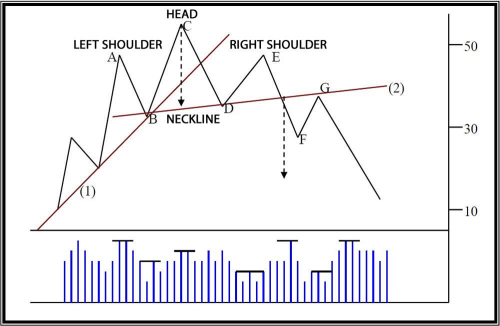

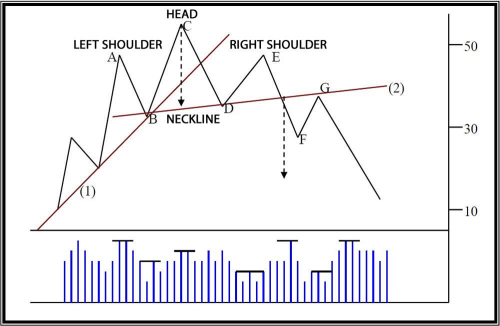

Fig.1: The head and shoulders pattern (reversal)

It’s the reversal pattern best known, and probably the most successful to predict trend changes. On the fig. 1, we can see a representation of it, in it can be seen a series of rising peaks and valleys that begin to lose strength. Underlying, what is happening is that the forces of supply and demand are in momentary balance.

A head and shoulders pattern generally has the following specifications:

1. A prior uptrend.

2. The left shoulder (point A) has a significant volume, followed by a decline to point B with less volume.

3. A rise to a new high (point C), but with less volume than point A.

4. A decline that drops below the crest of the point A, breaks the trend line (1) and approaches the previous low (point D).

5. A third price increase (point E) with significantly less volume and the head cannot overcome (point C).

6. A drop below the base of the neckline, confirming the pattern (2).

7. Finally, after the pattern is confirmed, a recovery to (point G).

This pattern enables a target price after confirmation, this objective is set as the distance between the head point (point C) and the neckline (2) projected down from the neckline. In the fig. 1, we see this through the dotted arrow. This is a minimum target, that is, the prices, as minimum, reach to that zone. The Inverted Head and Shoulders Pattern case is analogous.

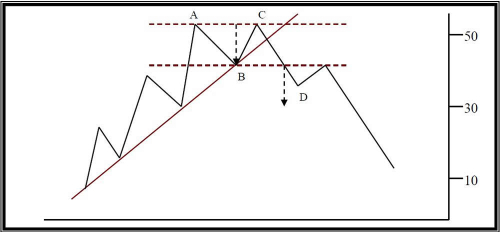

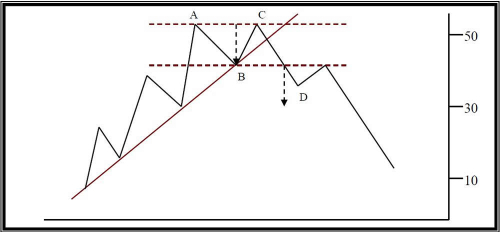

Fig. 2: The Double Top Pattern (reversal)

Fig. 2: The Double Top Pattern (reversal)

The Double Top and Double Bottom patterns, after the head and shoulders pattern, are the easiest to identify.

In fig. 2 we can see the representation of the double top pattern. As we can see, the bullish strength decrease and the maximum of the point C cannot exceed the maximum of the point A. Then, the trend line break occurs, and finally, the pattern is confirmed when prices fall below the price level of the point B, the dotted arrow represents the minimum target prices below the break of the point B imaginary line.

The distance between the imaginary line of points A and C and the imaginary line of point B. projected below the imaginary line of point B, is the minimum target expected. The Double Bottom case is analogous.

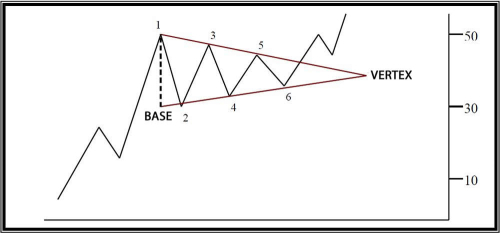

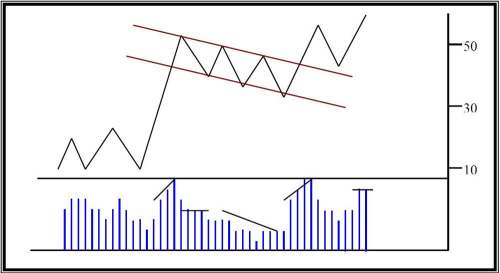

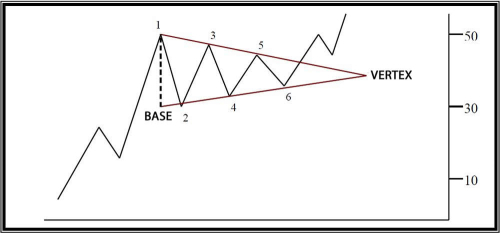

Fig. 3: The Triangle (continuation)

Fig. 3: The Triangle (continuation)

There are three types of triangles: symmetrical, ascending and descending. The triangle is an intermediate pattern referring to the time it takes to form. Some characteristics of all triangles are:

• The triangles volume tends to decrease as the price crosses the convergence channel, but should grow significantly in the break. The convergence channel is this zone, between the trend lines.

• The triangles have a limit time of resolution, which is the time of trendlines convergence (the triangle vertex in the fig. 3 is the time limit).

• Measuring the vertical height in the widest part of the triangle, we obtain the minimum target that the prices should scroll in the corresponding direction at the termination time. (In the fig. 3 we can see a previous uptrend, then, this distance will be the minimum target, projected above the resolution point).

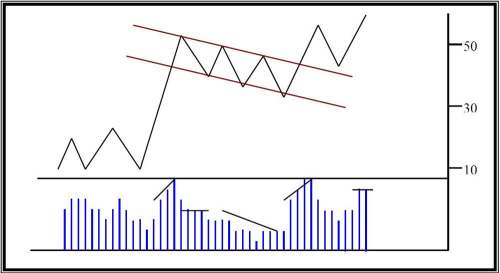

Fig. 4: The Flag Pattern (continuation)

Fig. 4: The Flag Pattern (continuation)

In the fig. 4, we can see the flag pattern, these patterns are quite common and represent a brief pause in a sudden prices movement and after, the movement will continue in the same direction. One of the conditions for the existence of this pattern is that it is preceded by a sudden movement (almost perpendicular).

During the development of this pattern, we observe a large decrease in volume, but the volume increases abruptly at the end.

This pattern occurs approximately at the half market movement (uptrend or downtrend), that is, it is expected that there is a continuation of the initial movement of the same size that from the initial break until the pattern. This distance is expected to be repeated at the end in the same direction.

Looking for patterns in financial time series is the key objective of a technical analyst. These patterns are indicative of reversal trend or continuation trend.

Formally, patterns in financial time series from the point of view of the technical analysis are "images or formations that appear on price charts." These can be classified into different categories and have predictive value.

The reversal patterns

These patterns announcing that it is causing a significant change in the trend. The reversal patterns have common characteristics, among which we can mention:

• There must be a precise previous trend, that is, there cannot be a trend change if there is no clear previous trend.

• In general, the first change sign is the breaking of a trend line. It is important to note that the opposite is not true, the trend line break does not necessarily mean a change in the trend, and this can mean only a change in the trend slope.

• While more big is the pattern, more big is the movement associated with their occurrence, where "more big” refers to the height and width of the pattern, the height measures the volatility and the width, the time in which it is formed.

As is standard in technical analysis, does not mean it always will produce all these characteristics, only that there is a significant probability of occurring.

The continuation patterns

These patterns indicate that lateral movement that shows the chart is a pause and then the original trend will continue. The continuation patterns take less time to form that the reversal patterns.

Importantly, both patterns (continuation and reversal) are not deterministic, they are stochastic in nature, that is, when these patterns are formed there is a significant probability that the market movement behaves as expected, but we must remember that there is also the probability, (lower but not null), that this is not so.

Now, we will see some patterns examples:

Fig.1: The head and shoulders pattern (reversal)

Fig.1: The head and shoulders pattern (reversal)It’s the reversal pattern best known, and probably the most successful to predict trend changes. On the fig. 1, we can see a representation of it, in it can be seen a series of rising peaks and valleys that begin to lose strength. Underlying, what is happening is that the forces of supply and demand are in momentary balance.

A head and shoulders pattern generally has the following specifications:

1. A prior uptrend.

2. The left shoulder (point A) has a significant volume, followed by a decline to point B with less volume.

3. A rise to a new high (point C), but with less volume than point A.

4. A decline that drops below the crest of the point A, breaks the trend line (1) and approaches the previous low (point D).

5. A third price increase (point E) with significantly less volume and the head cannot overcome (point C).

6. A drop below the base of the neckline, confirming the pattern (2).

7. Finally, after the pattern is confirmed, a recovery to (point G).

This pattern enables a target price after confirmation, this objective is set as the distance between the head point (point C) and the neckline (2) projected down from the neckline. In the fig. 1, we see this through the dotted arrow. This is a minimum target, that is, the prices, as minimum, reach to that zone. The Inverted Head and Shoulders Pattern case is analogous.

Fig. 2: The Double Top Pattern (reversal)

Fig. 2: The Double Top Pattern (reversal)The Double Top and Double Bottom patterns, after the head and shoulders pattern, are the easiest to identify.

In fig. 2 we can see the representation of the double top pattern. As we can see, the bullish strength decrease and the maximum of the point C cannot exceed the maximum of the point A. Then, the trend line break occurs, and finally, the pattern is confirmed when prices fall below the price level of the point B, the dotted arrow represents the minimum target prices below the break of the point B imaginary line.

The distance between the imaginary line of points A and C and the imaginary line of point B. projected below the imaginary line of point B, is the minimum target expected. The Double Bottom case is analogous.

Fig. 3: The Triangle (continuation)

Fig. 3: The Triangle (continuation)There are three types of triangles: symmetrical, ascending and descending. The triangle is an intermediate pattern referring to the time it takes to form. Some characteristics of all triangles are:

• The triangles volume tends to decrease as the price crosses the convergence channel, but should grow significantly in the break. The convergence channel is this zone, between the trend lines.

• The triangles have a limit time of resolution, which is the time of trendlines convergence (the triangle vertex in the fig. 3 is the time limit).

• Measuring the vertical height in the widest part of the triangle, we obtain the minimum target that the prices should scroll in the corresponding direction at the termination time. (In the fig. 3 we can see a previous uptrend, then, this distance will be the minimum target, projected above the resolution point).

Fig. 4: The Flag Pattern (continuation)

Fig. 4: The Flag Pattern (continuation)In the fig. 4, we can see the flag pattern, these patterns are quite common and represent a brief pause in a sudden prices movement and after, the movement will continue in the same direction. One of the conditions for the existence of this pattern is that it is preceded by a sudden movement (almost perpendicular).

During the development of this pattern, we observe a large decrease in volume, but the volume increases abruptly at the end.

This pattern occurs approximately at the half market movement (uptrend or downtrend), that is, it is expected that there is a continuation of the initial movement of the same size that from the initial break until the pattern. This distance is expected to be repeated at the end in the same direction.