Even though the book “Methods of a Wall Street Master” was written many years ago its content is timeless and worth reading as it is full of trading methods, techniques, discipline, risk management, trading psychology and much more.

The trading philosophy of Victor Sperandeo is based on capital preservation, regular profitability in trading, and the pursuit of superior returns.

His main method of trading is based on Dow Theory. He believes that if a trader knows what the trend is, and if knows also when it is most likely to change, then he/she really has all the needed knowledge to make money in the markets.

To be a success traders should:

The purpose of trading rules is to make executions as consistent and objective as humanly possible.

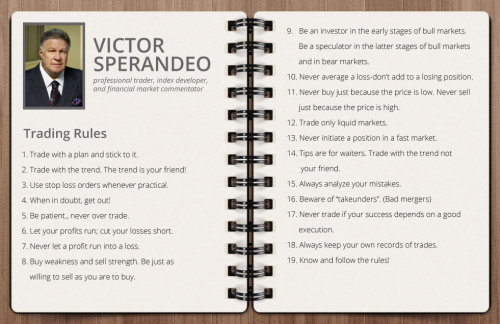

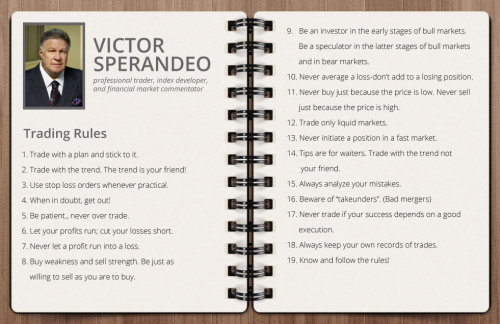

In his book he writes about 19 rules that are mainly designed for short-term traders, however, some of them can be effectively adopted by long-term traders.

Here are the rules. You will probably be familiar with most of them if you have studied other trading legends.

The trading philosophy of Victor Sperandeo is based on capital preservation, regular profitability in trading, and the pursuit of superior returns.

His main method of trading is based on Dow Theory. He believes that if a trader knows what the trend is, and if knows also when it is most likely to change, then he/she really has all the needed knowledge to make money in the markets.

To be a success traders should:

- Set goals.

- Attain knowledge of the markets.

- Define trading rules that work.

- Execute in strict loyalty to the trading rules.

The purpose of trading rules is to make executions as consistent and objective as humanly possible.

In his book he writes about 19 rules that are mainly designed for short-term traders, however, some of them can be effectively adopted by long-term traders.

Here are the rules. You will probably be familiar with most of them if you have studied other trading legends.