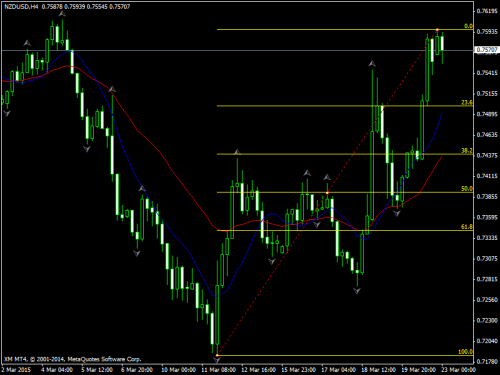

Last week i took a buy trade on the NZD after the initial retracement because i missed the first swing after the AB-CD retracement down. But i was able to get 160 pips out of it. THe currency still looks interesting so i'll be looking into it this week as well.

The current picture looks tricky because the monthly and weekly timeframe is still buying and market just bouced off the 38% retracement on monthly timeframe while the daily showing a change in trend to buy and 4hours still holding the buy signal.

That’s being said we can’t count on bullish sentiment on NZD in medium-term perspective as from fundamental as from technical point of view. Current upward action we should treat as retracement. At the same time, as retracement stands on monthly chart, we can’t exclude that market will form some pattern that will lead market to higher retracement.

In short-term perspective we continue to ride on upside retracement and try to catch entry in next upside leg.

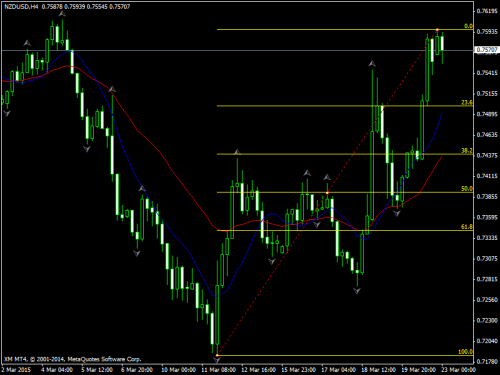

The current picture looks tricky because the monthly and weekly timeframe is still buying and market just bouced off the 38% retracement on monthly timeframe while the daily showing a change in trend to buy and 4hours still holding the buy signal.

That’s being said we can’t count on bullish sentiment on NZD in medium-term perspective as from fundamental as from technical point of view. Current upward action we should treat as retracement. At the same time, as retracement stands on monthly chart, we can’t exclude that market will form some pattern that will lead market to higher retracement.

In short-term perspective we continue to ride on upside retracement and try to catch entry in next upside leg.