November Release of Dukascopy Bank Sentiment Index

Video version of the report will be available here.

- The six-month global economic expectations improved in November, whereas the three-year index decreased, a Dukascopy Bank SA poll showed. The six-month economic sentiment index inched up 0.01 to 0.63. The three-year

economic outlook worsened 0.02 to 0.71.

- Respondents did not change their view on the six-month European economic outlook, yet experts became less optimistic about the three-year economic expectations in November. The six-month economic sentiment index stood unchanged at 0.53, and the three-year economic sentiment index retreated 0.05 to 0.62.

- The North American six-month economic sentiment index advanced to 0.66 from 0.63 in October. The three-year outlook went up to 0.73, from 0.71 in October.

- The Asia-Pacific six-month expectations remained stable at 0.7 level, while the three-year economic outlook fell 0.02 to 0.78.

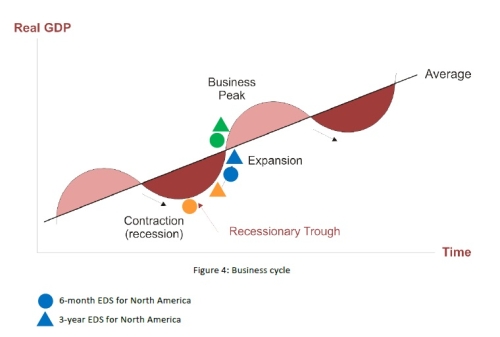

Figure 4 presents the business cycle and its phases - expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

Respondents are equally divided on the European six-month EDS. Fifteen claim the economy will be in a recession, while another half say the economy will be expanding, yet twenty two expect that the regional economy will gather pace in three years time.

Majority of experts support the view that the North American economy will be expanding both six months and three years from now.

Experts are largely united about the Asia-Pacific 6-month EDS – twenty forecast expansion and four say the economy will reach its peak. Twenty six respondents support the view that the Asia-Pacific economy will expand three years from now.

Figure 4: Business cycle

Video version of the report will be available here.

- The six-month global economic expectations improved in November, whereas the three-year index decreased, a Dukascopy Bank SA poll showed. The six-month economic sentiment index inched up 0.01 to 0.63. The three-year

economic outlook worsened 0.02 to 0.71.

- Respondents did not change their view on the six-month European economic outlook, yet experts became less optimistic about the three-year economic expectations in November. The six-month economic sentiment index stood unchanged at 0.53, and the three-year economic sentiment index retreated 0.05 to 0.62.

- The North American six-month economic sentiment index advanced to 0.66 from 0.63 in October. The three-year outlook went up to 0.73, from 0.71 in October.

- The Asia-Pacific six-month expectations remained stable at 0.7 level, while the three-year economic outlook fell 0.02 to 0.78.

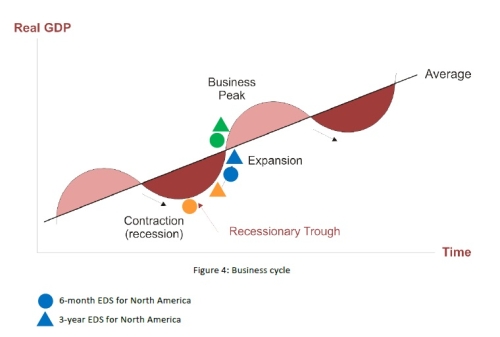

Figure 4 presents the business cycle and its phases - expansion (real GDP is increasing), peak (real GDP stops increasing and begins decreasing), contraction or recession (real GDP is decreasing), and trough (real GDP stops decreasing and begins increasing).

Respondents are equally divided on the European six-month EDS. Fifteen claim the economy will be in a recession, while another half say the economy will be expanding, yet twenty two expect that the regional economy will gather pace in three years time.

Majority of experts support the view that the North American economy will be expanding both six months and three years from now.

Experts are largely united about the Asia-Pacific 6-month EDS – twenty forecast expansion and four say the economy will reach its peak. Twenty six respondents support the view that the Asia-Pacific economy will expand three years from now.

Figure 4: Business cycle