Hi,

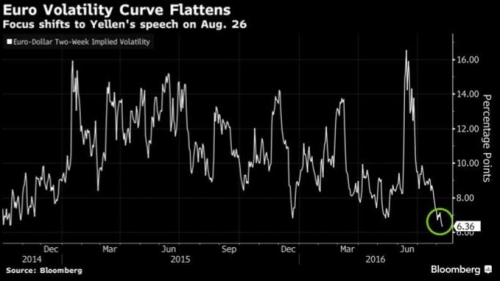

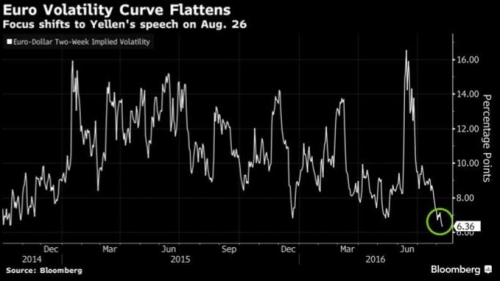

Even though in the beginning of the month we had some nice price movement the volatility is compressing right now and it's starting to feel like summer trading environment. Usually August is the season holiday for the most bankers and trading activity slows down during this time period.

Volatility is very important especially the implied volatility which is the expected volatility not just because it gives us a clue into potential swing movements but usually because major swing high/low in volatility is the precursor of swing high/low in price. It is no surprise that in the aftermath of Brexit event which catapulted the volatility to the highest level not seen in many years, subsequently we found a bottom in EUR/USD. Last week we almost retest the highest point prior to Brexit at 1.1427 and it may be the case that the low level of volatility will inspire and sustain the bullish momentum, however we can still expect sharp sell-off followed by quick rallies.

Best Regards,

Daytrader21

Even though in the beginning of the month we had some nice price movement the volatility is compressing right now and it's starting to feel like summer trading environment. Usually August is the season holiday for the most bankers and trading activity slows down during this time period.

Volatility is very important especially the implied volatility which is the expected volatility not just because it gives us a clue into potential swing movements but usually because major swing high/low in volatility is the precursor of swing high/low in price. It is no surprise that in the aftermath of Brexit event which catapulted the volatility to the highest level not seen in many years, subsequently we found a bottom in EUR/USD. Last week we almost retest the highest point prior to Brexit at 1.1427 and it may be the case that the low level of volatility will inspire and sustain the bullish momentum, however we can still expect sharp sell-off followed by quick rallies.

Best Regards,

Daytrader21