You can find my last update on the Nikkei index and the Japanese Yen here: Why are XXX/JPY Currency Pairs Rebounding?

To be quite honest I'm very impress by the accuracy of my prediction as it seems I've nailed every swing wave so far in the yen and Nikkei index. If you want to trade like a pro when trading the currency market you'll have to look at other correlated markets as well.

If you're trading only the Forex Exchange market don't make the mistake of not watching others market for more clues, like the equity market or the Interest Rates market which are having a big impact on forex exchange fluctuations. The world is much more complex and everything is interconnected so that's the reason why we'll have a look to the Nikkei index which is a stock market index for the Tokyo Stock Exchange, in order to make our analysis on USDJPY. We know that in order for the yen to go down the Nikkei index must go up this will be our confirmation. So basically we must have USDJPY going up and Nikkei Index going up as well. Having confirmation from related market can give you more conviction in your trading ideas.

Daytrader21

To be quite honest I'm very impress by the accuracy of my prediction as it seems I've nailed every swing wave so far in the yen and Nikkei index. If you want to trade like a pro when trading the currency market you'll have to look at other correlated markets as well.

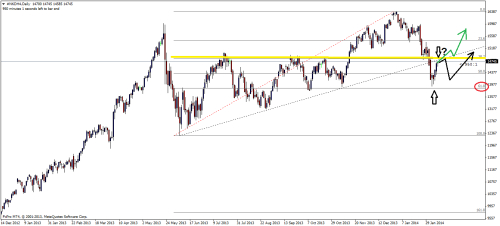

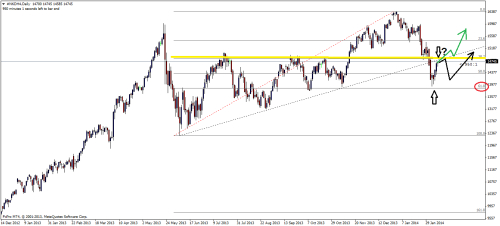

- Figure 1. Nikkei Daily Chart posted Monday.(Click on the picture to enlarge)

If you're trading only the Forex Exchange market don't make the mistake of not watching others market for more clues, like the equity market or the Interest Rates market which are having a big impact on forex exchange fluctuations. The world is much more complex and everything is interconnected so that's the reason why we'll have a look to the Nikkei index which is a stock market index for the Tokyo Stock Exchange, in order to make our analysis on USDJPY. We know that in order for the yen to go down the Nikkei index must go up this will be our confirmation. So basically we must have USDJPY going up and Nikkei Index going up as well. Having confirmation from related market can give you more conviction in your trading ideas.

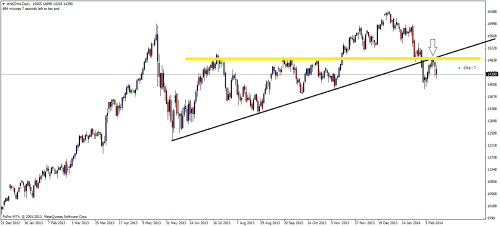

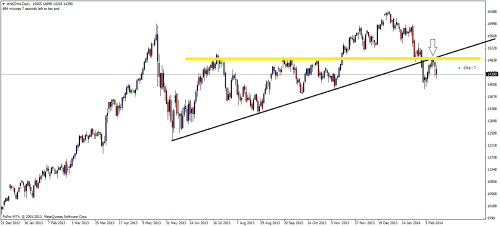

- Figure 2. Nikkei Index Recent Price Action(Click on the picture to enlarge).

- Figure 3. EUR/JPY Short Trade(Click on the picture to enlarge).

Daytrader21