The labor market seems to be picking up as the recent bad weather effect on the market is fading away and the job market has start picking up.

The labor market seems to be picking up as the recent bad weather effect on the market is fading away and the job market has start picking up. Market participants will pay close attention to this figures especially after Yellen has introduced the new qualitative forward guidance and employment data has become an indicator of economic growth.

Earlier this week the the ADP was released which came in closer to market expectation at 191k from previous reading of 139k, which can suggest that there is more growth to come. The ADP figures can give us a slightly view of what's ahead of us and how the NFP figures could look like.

- What to expect from today's data release? Trade pattern IDEA.

Rather than focusing on the NFP figures I think the unemployment rate has become a bigger factor now in the new qualitative forward guidance, because this are the data points that are going to shape what the time frame is going to be for FED interest rates hike. The rate hike carry a high impact not only for the dollar but also for the risk appetite trends.

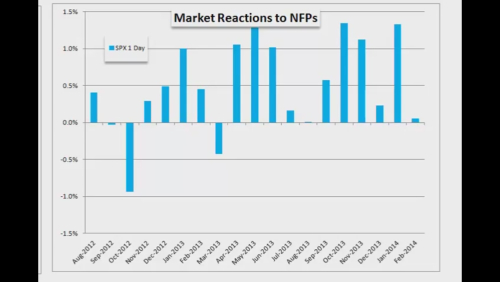

The day of the release of NFP is typically a bullish day for the S&P500 (see Figure 1) so this suggest we're having a RISK ON environment, this tells us that a good currency pair candidate to trade in such scenario is to go long AUD/USD. This is because RISK On promotes a yield view among investor. On the other hand In terms of risk aversion if the data disappoint I prefer to play to the downside the yen crosses

- Figure 1. Market Reactions to NFP.

Unemployment Rate: Expectation=7; Previous=7.

Best Regards,

Daytrader21.