Hi traders,

The Organization of the Petroleum Exporting Countries agreed on Friday to rein in member production cuts, essentially lifting output to help make up for an expected shortfall in global supplies. The expected output increase, however, appears likely to be smaller than market participants had expected.

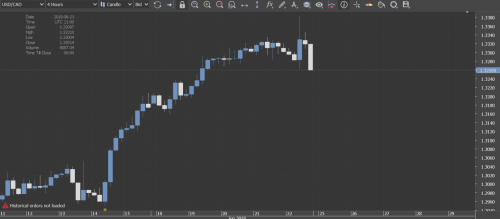

This news at first pushed USDCAD much higher to 1.3381 but then after hitting that level it has been a bearish ride since.

Late during US session, the price still goes down and it close at 1.3259 which is the low of day, Friday 22nd June 2018.

Traders could expect a gap down on market opening on Monday 25th or further downward moves on USDCAD next week.

Attached is the USDCAD chart on the 4H hour.

The Organization of the Petroleum Exporting Countries agreed on Friday to rein in member production cuts, essentially lifting output to help make up for an expected shortfall in global supplies. The expected output increase, however, appears likely to be smaller than market participants had expected.

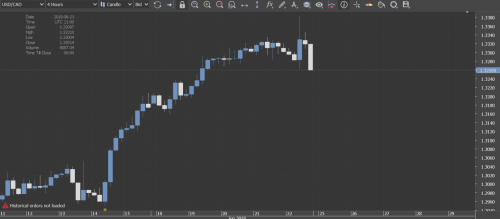

This news at first pushed USDCAD much higher to 1.3381 but then after hitting that level it has been a bearish ride since.

Late during US session, the price still goes down and it close at 1.3259 which is the low of day, Friday 22nd June 2018.

Traders could expect a gap down on market opening on Monday 25th or further downward moves on USDCAD next week.

Attached is the USDCAD chart on the 4H hour.