Jakson Hole is an economic symposium conference that has been hold each year since 1978 by the Federal Reserve Bank of Kansas City. For more than three decades this economic symposium has been gathering together Finance ministers, central bank presidents and academics from around the world. Jackson Hole theme for Aug. 21-23 2014 will be "Re-Evaluating Labor Dynamics".

Jakson Hole is an economic symposium conference that has been hold each year since 1978 by the Federal Reserve Bank of Kansas City. For more than three decades this economic symposium has been gathering together Finance ministers, central bank presidents and academics from around the world. Jackson Hole theme for Aug. 21-23 2014 will be "Re-Evaluating Labor Dynamics".Unfortunately many Wall Streeters and other private-sector economists have not been invited anymore signaling a shift from previous years and what is most important this is one way for governments to delimited from Wall Street at least in the eyes and perception of the general public.

Taking in consideration the conference topic, Yellen's speech will be the main focus as she will deliver her keynote speech at the Jackson Hole Symposium at 10:00AM Friday EST. Yellen has been very dovish especially on the US labor market and inflation outlook so most likely she will address her speech in that keynote. It may be the case we could see the US dollar retracing some of the recent strengths. However this will not change the bigger picture of a gradual interest rate normalization to occur during coming years.

- Why Jackson Hole matters?

Well, over the past seven years the Jackson Hole symposium has generated a stock-market rally each time. From 2007 through 2011, the DJIA has gained more than 100 points each time former Fed Chairman Ben Bernanke spoke.

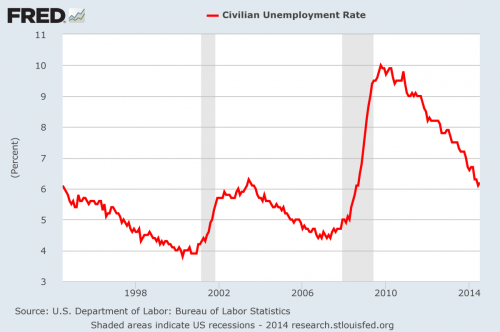

Figure 1. Unemployment Rate

When it comes to the unemployment rate it has fallen steadily(see Figure 1) and the economy has added 200,000 or more jobs in the last six months for the first time since 1997. The unemployment rate has also fallen to 6.2% from 7.3% a year ago. According to the FED projections they are expecting an unemployment rate of 6%-6.1% by year end, but the drop in unemployment rate is not reason enough for the FED to consider a healthy labor market because the number of job openings and labor force participation is also important, which has slightly declined.

Best Regards,

Daytrader21