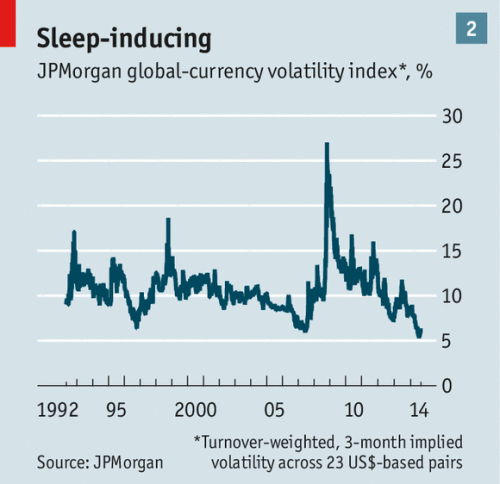

I'm sure that most of you guys are exasperated about the current never-ending low volatility environment(see Figure 1) as current market conditions has become increasingly challenging. The Forex Exchange market has been in a very deep sleep for the most part of this year and swing trading opportunities have vanished away and that's one of the reasons why in current low volatility environment the Carry Trading Strategy are preferred more as it makes sense that investors who are chasing yield to rush in and park their money with high yield currencies in seek for return, you can read more about this in my previous article here: Carry Trade Returns

I'm sure that most of you guys are exasperated about the current never-ending low volatility environment(see Figure 1) as current market conditions has become increasingly challenging. The Forex Exchange market has been in a very deep sleep for the most part of this year and swing trading opportunities have vanished away and that's one of the reasons why in current low volatility environment the Carry Trading Strategy are preferred more as it makes sense that investors who are chasing yield to rush in and park their money with high yield currencies in seek for return, you can read more about this in my previous article here: Carry Trade Returns Before going any further we need to define "Volatility", and the way I like to look at it is from two key perspective:

- How many times it moves(up and down) in a given period of time --> Frequency.

- How faster and bold is the move-->Severity.

In this regard the best definition of volatility I found it to be:"Volatility refers to the frequency and severity with which the market price of an investment fluctuates."

Figure 1. JPMorgan global-currency volatility index.

- [b]Why is Volatility so Low

[/b]Some research I've read so far state that the three-month realized volatility for USD/JPY has not been this low since 1977, and for EUR/USD since 1979. The one reason of this low volatility environment is because of the predictability in Central Bank's monetary policy, and this makes the market more stable, and market reach equilibrium points much faster. Another factor that contribute to this low volatility may be the changes in the FX market structure due to the Dodd-Frank act.

First step for any pro trader is to realize and identify the trading environment that he is trading in and second to have an definable strategy for that environment.

Ultimately at some point volatility will start picking up and move towards mean reversion, as low volatility environment is often followed by a reversion to the mean. And also some may argue that current Central Banks monetary policy divergence may play a factor in favor of the return in volatility, but that remains to be seen how faster it will happen.

Any subsequent change in market conditions will more likely bring the volatility back but we have to wait for a catalyst.

If You wish to continue reading further please go HERE: An Investor's Low Volatility Strategy

Best Regards,

Daytrader21