Since a new month has started the best way to asserts the probability of where the market is likely to be heading in this month is for us to look at the seasonality patterns. The seasonality cycles will bring in a new dimension in which you can analyse the market. Seasonality are a predictable change in price that repeats every day, week, month, year at the same period in time.

You can find more details how this seasonal patterns affect the exchange rate and more importantly how to correctly use them in your trading activity in one of my articles here: Seasonal Cycles in FX Trading

This seasonality cycles will only give you the tendency of an particular currency pair to bottom or top or rally or fall, at certain point in time. Going forward we're going to analyse what are the November seasonal patterns in FX market.

- Euro November Seasonal Pattern

Based on the seasonal cycles the 5yr and 15 yr averages price suggest further downside movement where the 10yr average stays more in consolidation. However taking in consideration current market driven theme it most likely to see EUR/USD trading to the downside.

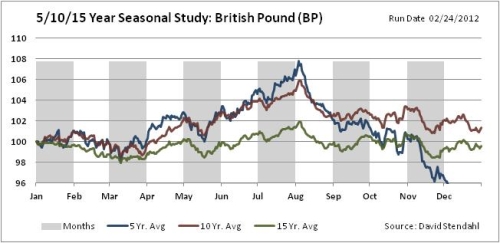

- GBP November Seasonal Pattern

November seems to be one of the worse month for cable and we can expect by the end of the month GBP/USD to put in place a major swing low. The pattern on the British pound it's quite clear so the probabilities are for a downside movement.

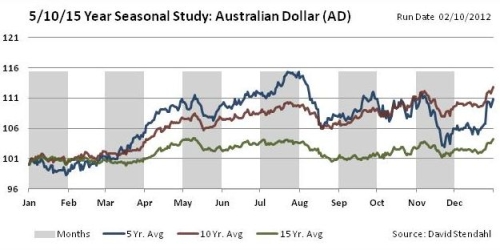

- AUD November Seasonal Pattern

The 5yr and 10yr average price points to a strong sell of and it comes out that November is one of the worse month for aussie. It may be the case aussie will follow the commodity market and break lower

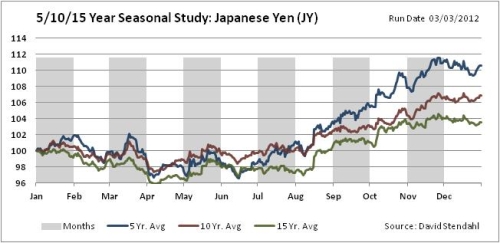

- Yen November Seasonal Pattern

Since BOJ has started the massive QE program we can see this seasonality patterns have reversed and usually as we enter the autumn season JPY is weakening not straightening as the seasonality may suggest.

Best Regards,

Daytrader21