Since a new month has started, the best way to asserts the probability of where the market is likely to be heading in this month is for us to look at the seasonality patterns. The seasonality cycles will bring in a new dimension in which you can analyse the market. Seasonality are a predictable change in price that repeats every day, week, month, year at the same period in time.

You can find more details how this seasonal patterns affect the exchange rate and more importantly how to correctly use them in your trading activity in one of my articles here: Seasonal Cycles in FX Trading

This seasonality cycles will only give you the tendency of an particular currency pair to bottom or top or rally or fall, at certain point in time. Going forward we're going to analyse what are the November seasonal patterns in FX market.

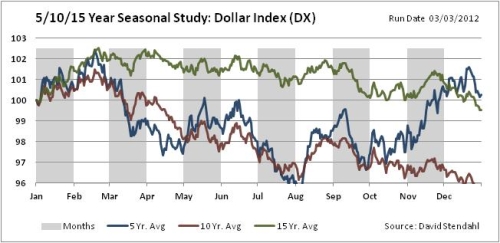

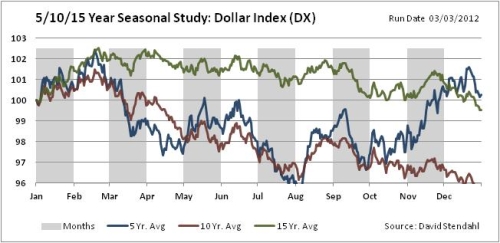

I would like to start first by looking at the broad based dollar strength/weakness because of the current massive bullish dollar trend, every move in the FX land will be depended on the dollar move. It comes as no surprise last month general weakness in the Dollar, look at the chart above how strong the cycle was during that time of the year, you just couldn't ignore it. Going into May we can tell that during the first half of the month the dollar start resuming his bullish trend and corrects part of the recent weakness, however in the second half of the month we should expect again more weakness that extends all the way through Jun and July.

The euro follows the dollar lead during this month and nothing major is on the cards during this time of the year so we should expect more consolidation and within this consolidation we should expect during first part of the month some weakness followed by some strength later in the month.

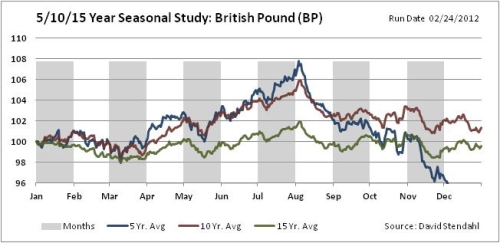

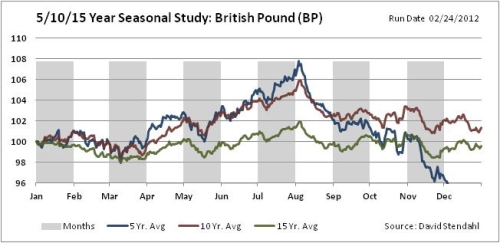

The same as euro, the British Pound seems to move in accordance with the dollar pattern, just the the moves are more severe than in euro case, we also have to take in consideration the General Election Cycle which point towards further risk.

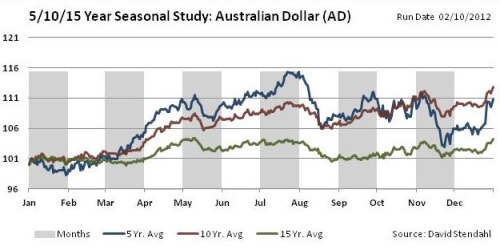

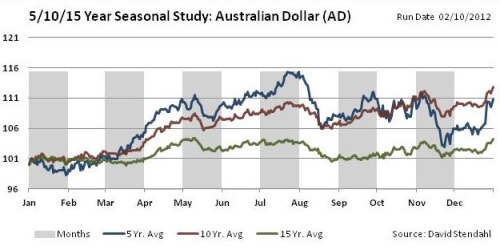

In AUD we should look for the same pattern, because this seasonality tendency reflects in all the USD crosses it's a powerful sign that we're most likely to follow this pattern than not. If we look just on the AUD/USD seasonality effect we can see that it's reversing all the gains from previous month so we should expect more weakness than with the other pairs.

In AUD we should look for the same pattern, because this seasonality tendency reflects in all the USD crosses it's a powerful sign that we're most likely to follow this pattern than not. If we look just on the AUD/USD seasonality effect we can see that it's reversing all the gains from previous month so we should expect more weakness than with the other pairs.

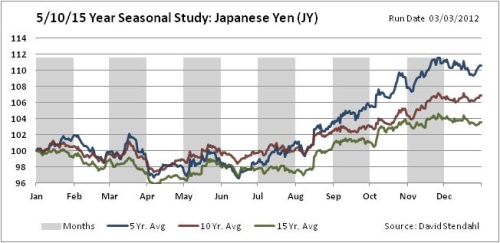

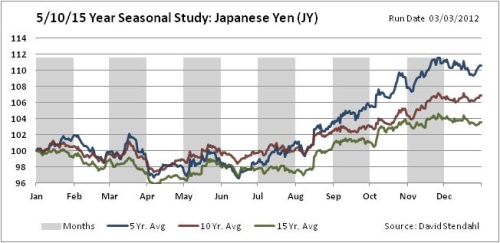

If we consolidate for the most part of this year and the bigger bullish USD/JPY has not made new highs we can expect some correction as the seasonality pattern also suggest JPY strength during this time of the year, so look for a breakout to the downside in USD/JPY

Best Regards,

Daytrader21

You can find more details how this seasonal patterns affect the exchange rate and more importantly how to correctly use them in your trading activity in one of my articles here: Seasonal Cycles in FX Trading

This seasonality cycles will only give you the tendency of an particular currency pair to bottom or top or rally or fall, at certain point in time. Going forward we're going to analyse what are the November seasonal patterns in FX market.

- Dollar Index May Seasonal Pattern

I would like to start first by looking at the broad based dollar strength/weakness because of the current massive bullish dollar trend, every move in the FX land will be depended on the dollar move. It comes as no surprise last month general weakness in the Dollar, look at the chart above how strong the cycle was during that time of the year, you just couldn't ignore it. Going into May we can tell that during the first half of the month the dollar start resuming his bullish trend and corrects part of the recent weakness, however in the second half of the month we should expect again more weakness that extends all the way through Jun and July.

- Euro May Seasonal Pattern

The euro follows the dollar lead during this month and nothing major is on the cards during this time of the year so we should expect more consolidation and within this consolidation we should expect during first part of the month some weakness followed by some strength later in the month.

- GBP May Seasonal Pattern

The same as euro, the British Pound seems to move in accordance with the dollar pattern, just the the moves are more severe than in euro case, we also have to take in consideration the General Election Cycle which point towards further risk.

- AUD May Seasonal Pattern

In AUD we should look for the same pattern, because this seasonality tendency reflects in all the USD crosses it's a powerful sign that we're most likely to follow this pattern than not. If we look just on the AUD/USD seasonality effect we can see that it's reversing all the gains from previous month so we should expect more weakness than with the other pairs.

In AUD we should look for the same pattern, because this seasonality tendency reflects in all the USD crosses it's a powerful sign that we're most likely to follow this pattern than not. If we look just on the AUD/USD seasonality effect we can see that it's reversing all the gains from previous month so we should expect more weakness than with the other pairs.- JPY April Seasonal Pattern

If we consolidate for the most part of this year and the bigger bullish USD/JPY has not made new highs we can expect some correction as the seasonality pattern also suggest JPY strength during this time of the year, so look for a breakout to the downside in USD/JPY

Best Regards,

Daytrader21