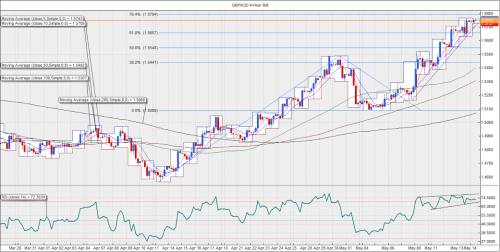

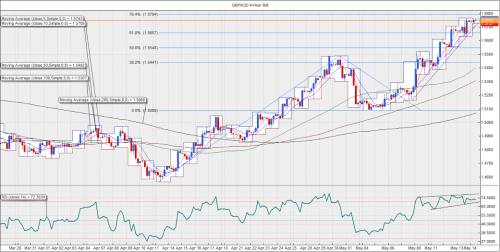

The USD sellers came-in strong on Wednesday following the weaker-than-expected US retail sales data. The offers on USD ensured the GBP/USD pair recovered from the post-UK inflation report low of 1.5632 to clock an intraday high of 1.5767. The BOE inflation report was slightly less hawkish than expected, as the bank revised its GDP and inflation forecasts lower. Contrary to expectations, the bank also held onto its view that inflation could fall below zero in the short-term. Overall the bank does not see a rate hike happening before 2016, however, at the moment the markets believe that a BOE rate hike could precede the fed rate hike. The market perception is due to the diverging economic data out of the US and the UK. The average weekly earnings in the UK rose 1.9% Vs. expected 1.7%, while the unemployment rate fell to 5.5%. Meanwhile, the US advance retail sales growth stagnated in April following a 1.1% rise in March. The USD sell trade is at a risk of a better-than-expected weekly jobless claims report in the US due later today.The pair currently trades 1.5750, after having finished above 1.57 levels in the previous session. On the 4-hour chart, the RSI has hit the overbought region and appears to be moving in a sideways channel, while on the hourly chart, the bearish RSI divergence has been confirmed. Consequently, the pair could dip to 1.57-1.5720. The rising trend line support on the 4-hour chart is seen around 1.57, thus, a break below the same could open doors for a sell-off towards 1.5650 levels. On the other hand, the immediate upside appears capped at 1.5794 (76.4% Fib exp of 1.4564-1.5490-1.5088). The pair is likely to be offered as fresh bids are likely once the pair confirms a daily close above 1.58.