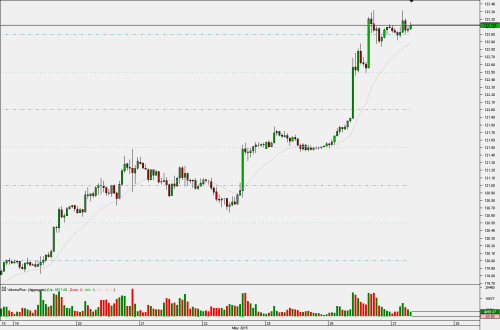

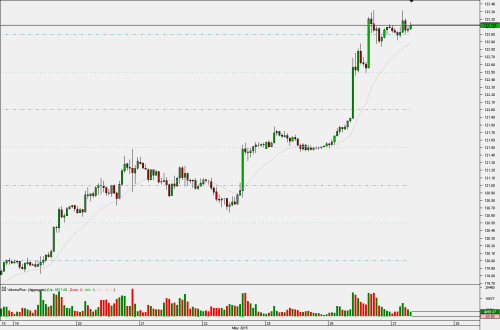

USD/JPY broke out of the six month trading range (115.50 - 122.00) yesterday and traded up to 123.30, adding more than 150 pips from the open. It wasn't able to follow through overnight as it remained in tight consolidation between 122.80 and 123.30. We'll see soon enough if this rally still has some legs, when European traders will start coming to their desks shortly.

July 2007 (123.67) and June 2007 (124.14) highs appear to be the main resistance levels nearby. Pivot point resistance levels may be worth watching too, Daily Resistance 1 (123.79), Daily Resistance 2 (124.47), Weekly Resistance 3 (124.66), but in these kind of markets (strong breakout and momentum) they may have little impact, if any at all.

July 2007 (123.67) and June 2007 (124.14) highs appear to be the main resistance levels nearby. Pivot point resistance levels may be worth watching too, Daily Resistance 1 (123.79), Daily Resistance 2 (124.47), Weekly Resistance 3 (124.66), but in these kind of markets (strong breakout and momentum) they may have little impact, if any at all.