In this article we’re going to look at both the technical setup as well as the fundamental themes that have been dictating the movements in the FX Market for the month of September and what’s going to drive the market forward in the coming month. The fact that we haven’t been able to see a rally in the equity market and a continuous decline in the US Dollar it tells us that something significant is happening, and that is a shift in the belief of monetary policy and its influences over the markets. We know that the monetary policy is one of the more proactive, impressive and constantly present mover in the market, it’s a theme that has been responsible for much of the moves that we had over the past month and year as well.

In this article we’re going to look at both the technical setup as well as the fundamental themes that have been dictating the movements in the FX Market for the month of September and what’s going to drive the market forward in the coming month. The fact that we haven’t been able to see a rally in the equity market and a continuous decline in the US Dollar it tells us that something significant is happening, and that is a shift in the belief of monetary policy and its influences over the markets. We know that the monetary policy is one of the more proactive, impressive and constantly present mover in the market, it’s a theme that has been responsible for much of the moves that we had over the past month and year as well.

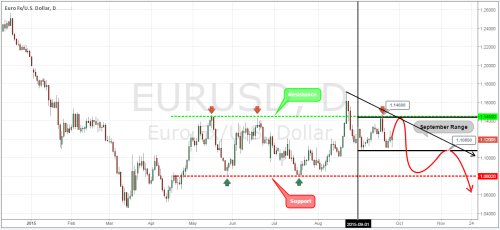

- EUR/USD Fundamental&Technical Analysis

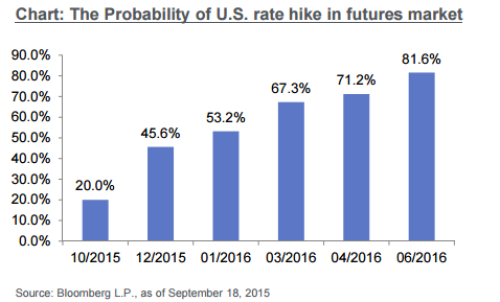

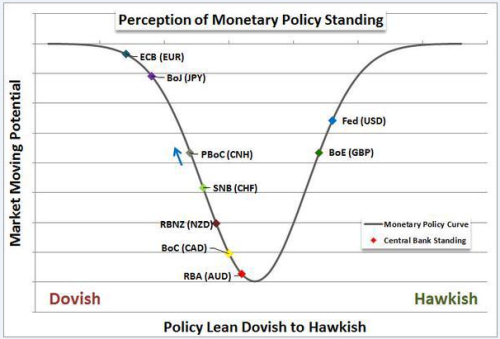

Without a doubt the major event of the month of September was the FED rate decision to hold interest rates near historically low level. However, despite no rate hike the Fed still remains one of the major Central Banks that still has a hawkish stance and the fact that they have stopped easing it’s reason enough to support the US Dollar at least in the short term. In comparison, the ECB is on the other side of the monetary policy spectrum as they are doing a massive QE program.

From a fundamental perspective the effect is to broaden the gap between the Fed and ECB monetary policy standings. In practical terms, this means lowering the yield potential for the euro and it encourage investors to use it as a short side currency and even if the US Dollar stands stagnant it’s providing more value because it’s maintaining its yield forecast.

The interest rates have been one of the biggest market drivers and in the coming month will continue to be one of the biggest drivers. The ECB was giving us ongoing rhetoric related to the possibility of upgrading the QE program and that’s going to be a theme that we’re going to have to keep a very close eye in the coming month. If you want to see the EUR/USD continue to decline in anticipation of more monetary policy, we have to have something that’s really convincing otherwise the technical factors can play a much bigger role in determining the direction of EUR/USD.

Please go here if you want to read the whole Article: October Fx Market Outlook

Best Regards,

Daytrader21

.