In Yesterday's blog post I wrote about a technical short setup ahead of the RBA statement. The result turned out to be bullish.

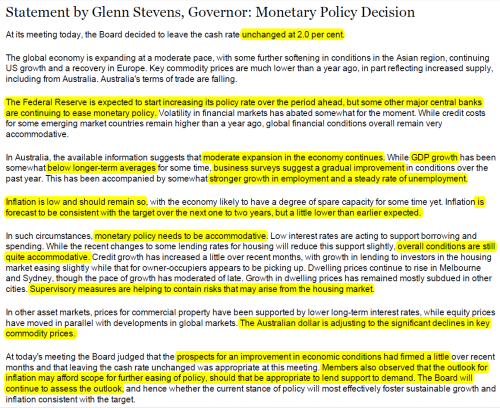

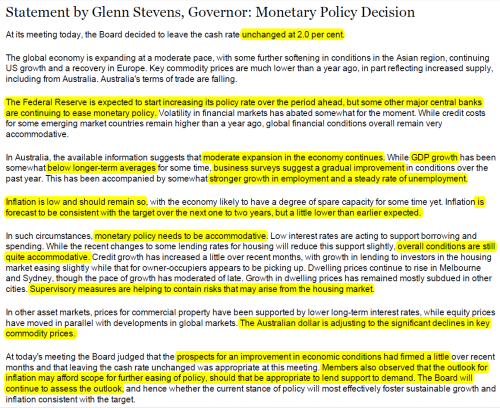

I have taken some time to highlight some key points from my interpretation of the statement. It is included in the image below.

The main impression left from the statement was quite positive. The RBA addressed inflation, as expected as it is a global concern, however they have realistic expectations in regards to the low levels of inflation and expect that may remain so. They acknowledge that their previous efforts in monetary policy (previous rate cut) has helped economic conditions. They cited that GDP could use some improvement, which it already looks on track for, as well labour numbers have been coming in quite strong, which speaks volumes about economic conditions in Australia.

In fact the only negative item on the statement was the inclusion of potential further easing directly related to inflation levels and outlook. Although that came across slightly negative, the paragraph on inflation earlier on in the report did essentially state the low levels of inflation were anticipated and provided the appearance that the RBA were not overly concerned at this point.

The final point, Which comes from the second paragraph. It appears the RBA are expecting the FED to raise soon. This will help their currency depreciate even further. In the short term, if we don't see a Dec Fed rate hike, this probably will not be an issue, but moving further into 2016 if the Fed continues to drag it's feet, we may see a shift in verbiage in the RBA statements at that time.

I have taken some time to highlight some key points from my interpretation of the statement. It is included in the image below.

The main impression left from the statement was quite positive. The RBA addressed inflation, as expected as it is a global concern, however they have realistic expectations in regards to the low levels of inflation and expect that may remain so. They acknowledge that their previous efforts in monetary policy (previous rate cut) has helped economic conditions. They cited that GDP could use some improvement, which it already looks on track for, as well labour numbers have been coming in quite strong, which speaks volumes about economic conditions in Australia.

In fact the only negative item on the statement was the inclusion of potential further easing directly related to inflation levels and outlook. Although that came across slightly negative, the paragraph on inflation earlier on in the report did essentially state the low levels of inflation were anticipated and provided the appearance that the RBA were not overly concerned at this point.

The final point, Which comes from the second paragraph. It appears the RBA are expecting the FED to raise soon. This will help their currency depreciate even further. In the short term, if we don't see a Dec Fed rate hike, this probably will not be an issue, but moving further into 2016 if the Fed continues to drag it's feet, we may see a shift in verbiage in the RBA statements at that time.