The pair initially tried to rally during the day on Friday but turned back around and crashed into the 1.08 level. I feel that this market isn’t ready to make any serious moves.

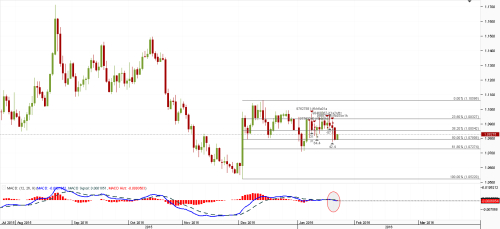

In 4 hours chart, the EUR/USD continues to build a corrective chart pattern with support (black) and resistance (red) marking its boundaries.

But In Daily Chart, Momentum has turned negative with the MACD (moving average convergence divergence) index generating a sell signal.

Any excess bearishness from the ECB President and the Euro might threaten to break below its lows.

I think if the pairs break 1.079 - 1.081 area (50% fibo and Monthly Pivot), it can dropped 1.072 (61% fibo)

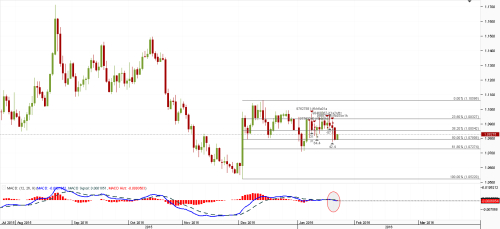

In 4 hours chart, the EUR/USD continues to build a corrective chart pattern with support (black) and resistance (red) marking its boundaries.

But In Daily Chart, Momentum has turned negative with the MACD (moving average convergence divergence) index generating a sell signal.

Any excess bearishness from the ECB President and the Euro might threaten to break below its lows.

I think if the pairs break 1.079 - 1.081 area (50% fibo and Monthly Pivot), it can dropped 1.072 (61% fibo)