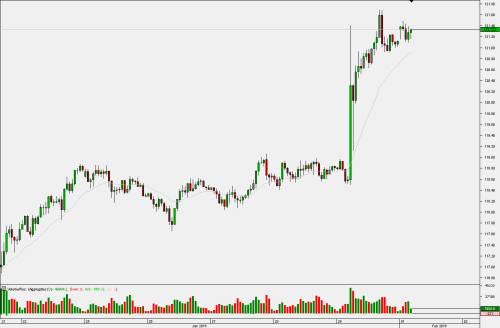

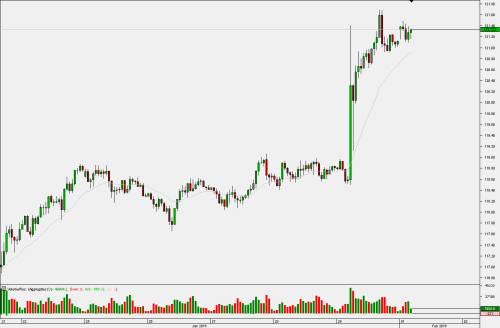

The yen is probably where the focus at the beginning of the week will be. We didn't see the kind of one-way market reaction after the BOJ adopted negative rates on Friday as those that followed introduction (April 2013) and expansion (October 2014) of QQE. Which is understandable - the latter is often seen as the ultimate tool for policy easing plus there was much less surprise factor present this time around.

Also, this market is not the same as in 2013 and 2014. Themes and sentiment are quite different too. There is so called "Kuroda line" at 125.00, though I'd think that Japanese officials would choose weaker over stronger yen any day. Traders will likely exercise more caution about chasing this market.

Also, this market is not the same as in 2013 and 2014. Themes and sentiment are quite different too. There is so called "Kuroda line" at 125.00, though I'd think that Japanese officials would choose weaker over stronger yen any day. Traders will likely exercise more caution about chasing this market.