hi traders , members and friends .

in fact it is a big field , in old books and researches it call " SMART MONEY " or " COMPUTATIONAL FINANCES " ..all of this around ARTIFICIAL INTELLIGENCE .

The New Oxford American Dictionary provides the following definition of optimize: “To make the best or most effective use of.”

According to this definition, then, to optimize a trading strategy is to make the most effective use of it .

In a practical sense, the optimization process is the calculation of the historical performance of a number of different instances of the trading strategy on a fixed historical price sample. For example, referring back to the MA trading strategy, an optimization of this strategy will entail the calculation of the historical performance of all of the different combinations of moving average lengths under examination on a historical sample of EUR/USD price data ranging from 1/1/1995 to 12/07/2015 .

for example :

moving price crossover above and below , when apply optimization in fact it test all the parameters and results

ma 2 --> drawdown 0.0050 - percent of profitable trades 77 % - number of all trades 88 - profit/loss 5.06

ma 3 --> drawdown 0.0021 - percent of profitable trades 30 % - number of all trades 88 - profit/loss 0.5

ma 4 --> drawdown 0.0077 - percent of profitable trades 54 % - number of all trades 88 - profit/loss 1.52

ma 5 --> drawdown 0.0039 - percent of profitable trades 80.06 % - number of all trades 88 - profit/loss 1025

ma 6 --> drawdown 0.0150 - percent of profitable trades 60 % - number of all trades 88 - profit/loss 2.83

ma 7 --> drawdown 0.0043 - percent of profitable trades 81 % - number of all trades 88 - profit/loss 31

ma 8 --> drawdown 0.0280 - percent of profitable trades 100 % - number of all trades 88 - profit/loss 0

etc............................ ( These figures purpose of explanation and clarification , not for real trading )

optimization technique just test and show us the results of all moving parameters , then we decide and choose the best one .

of course u may try to test dozens or even if thousand of trading strategy to choose the best one and the best indicators parameters .

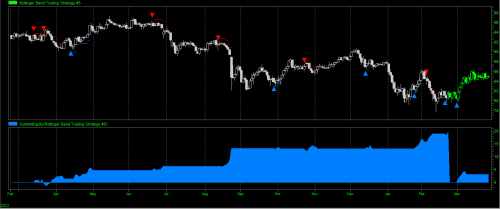

IN the picture we just had optimize " 2 bollinger bands trading strategy "

IN the picture we just had optimize " 2 bollinger bands trading strategy "

to be continue .....

in fact it is a big field , in old books and researches it call " SMART MONEY " or " COMPUTATIONAL FINANCES " ..all of this around ARTIFICIAL INTELLIGENCE .

The New Oxford American Dictionary provides the following definition of optimize: “To make the best or most effective use of.”

According to this definition, then, to optimize a trading strategy is to make the most effective use of it .

In a practical sense, the optimization process is the calculation of the historical performance of a number of different instances of the trading strategy on a fixed historical price sample. For example, referring back to the MA trading strategy, an optimization of this strategy will entail the calculation of the historical performance of all of the different combinations of moving average lengths under examination on a historical sample of EUR/USD price data ranging from 1/1/1995 to 12/07/2015 .

for example :

moving price crossover above and below , when apply optimization in fact it test all the parameters and results

ma 2 --> drawdown 0.0050 - percent of profitable trades 77 % - number of all trades 88 - profit/loss 5.06

ma 3 --> drawdown 0.0021 - percent of profitable trades 30 % - number of all trades 88 - profit/loss 0.5

ma 4 --> drawdown 0.0077 - percent of profitable trades 54 % - number of all trades 88 - profit/loss 1.52

ma 5 --> drawdown 0.0039 - percent of profitable trades 80.06 % - number of all trades 88 - profit/loss 1025

ma 6 --> drawdown 0.0150 - percent of profitable trades 60 % - number of all trades 88 - profit/loss 2.83

ma 7 --> drawdown 0.0043 - percent of profitable trades 81 % - number of all trades 88 - profit/loss 31

ma 8 --> drawdown 0.0280 - percent of profitable trades 100 % - number of all trades 88 - profit/loss 0

etc............................ ( These figures purpose of explanation and clarification , not for real trading )

optimization technique just test and show us the results of all moving parameters , then we decide and choose the best one .

of course u may try to test dozens or even if thousand of trading strategy to choose the best one and the best indicators parameters .

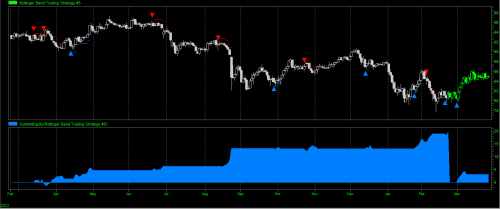

IN the picture we just had optimize " 2 bollinger bands trading strategy "

IN the picture we just had optimize " 2 bollinger bands trading strategy " to be continue .....